Actuarial Valuation Services in Saudi Arabia by MFD Services

What Is Actuarial Valuation and Why It Matters

Actuarial valuation is the process of assessing liabilities, assets, and risks using mathematical and statistical models. In Saudi Arabia, it is critical for pension funds, insurance companies, and corporates to comply with regulator‑mandated reporting standards.

MFD Services directly provides expert actuarial valuation in KSA, integrating financial modeling, compliance frameworks, and regulator‑aligned documentation. Our specialists deliver transparent, audit‑ready reports that ensure organizations meet SOCPA, IFRS, and global actuarial standards.

What Types of Actuarial Valuation Services Do Businesses Need

Employee Benefits Valuation

MFD Services prepares actuarial valuations for end‑of‑service benefits, pensions, and gratuity schemes. We calculate liabilities, discount rates, and future obligations, ensuring compliance with Saudi labor law and IFRS standards. Our reports are regulator‑ready and investor‑trusted.

Insurance Liability Valuation

We deliver actuarial valuations for insurance reserves, policyholder liabilities, and solvency requirements. MFD Services ensures compliance with Saudi Central Bank (SAMA) regulations, providing transparent documentation that supports financial stability and regulator confidence.

Pension Fund Valuation

MFD Services conducts actuarial valuations for pension schemes, assessing funding status, contribution adequacy, and long‑term sustainability. Our reports align with SOCPA and international actuarial standards, ensuring transparency and compliance.

Risk & Asset Valuation

We provide actuarial valuations for corporate risk exposures, investment portfolios, and asset‑liability management. MFD Services ensures organizations maintain regulator‑aligned risk frameworks and audit‑ready documentation.

What Are the Benefits of Actuarial Valuation

- Regulatory Compliance in KSA

Actuarial valuations ensure organizations meet Saudi regulatory requirements, including SOCPA and IFRS standards. MFD Services delivers audit‑ready reports that minimize regulator queries and penalties. - Financial Transparency

Valuations provide clear visibility into liabilities and risks. MFD Services ensures organizations maintain transparent records that build investor confidence and regulator trust. - Risk Management

Actuarial valuations identify financial risks and obligations. MFD Services designs frameworks that mitigate exposure, ensuring organizations remain compliant and financially secure. - Investor Confidence in Saudi Arabia

Transparent actuarial reports strengthen investor trust. MFD Services prepares regulator‑ready documentation that demonstrates accountability and financial stability.

Compliance Timelines for Actuarial Valuation in Saudi Arabia

- Employee Benefits Valuation

Completed within 4–6 weeks, ensuring compliance with IFRS and Saudi labor law. - Insurance Liability Valuation

Finalized within 6–8 weeks, aligned with SAMA requirements. - Pension Fund Valuation

Conducted annually, ensuring regulator‑aligned reporting and sustainability. - Risk & Asset Valuation

Completed within 3–5 weeks, ensuring audit‑ready documentation.

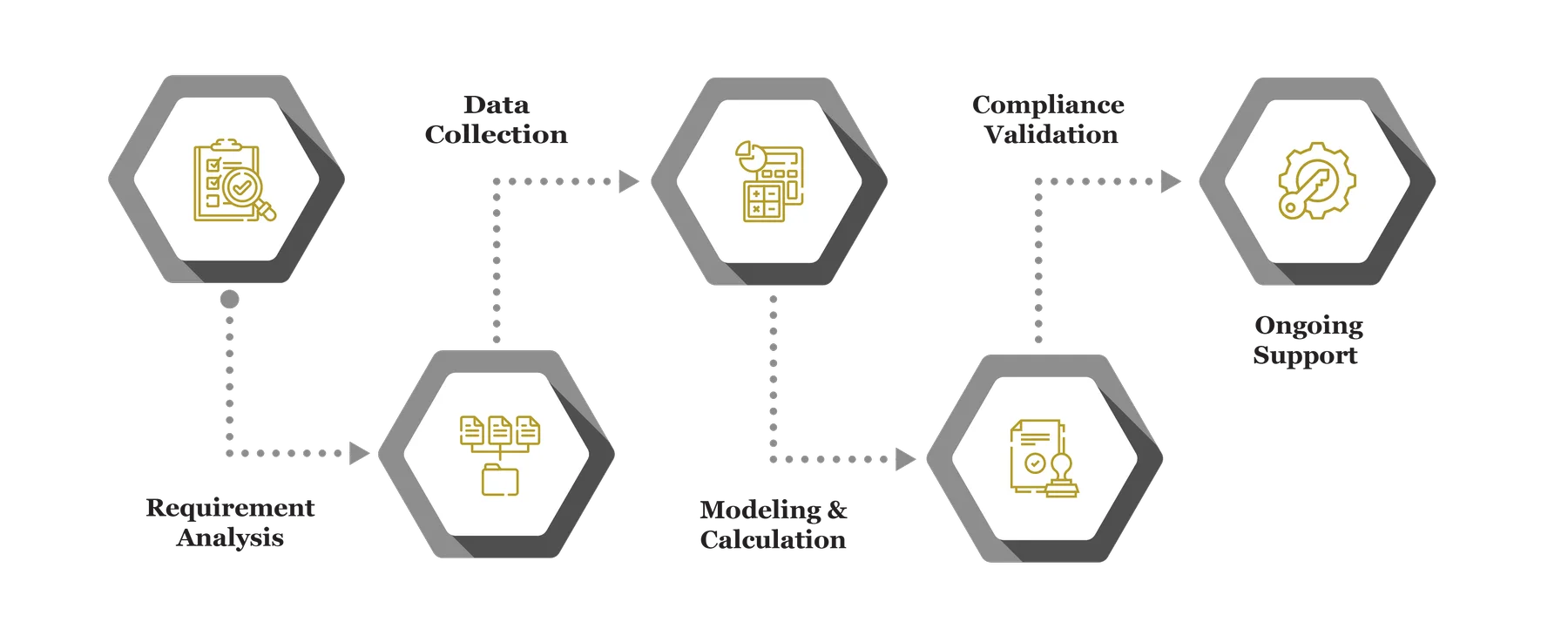

Our Process for Facilitating Actuarial Valuation

We design structured workflows that ensure timely valuations, regulator compliance, and audit‑ready documentation.

Requirement Analysis

We review actuarial needs, identify compliance gaps, and design valuation workflows aligned with Saudi regulations.

Data Collection

We gather employee, insurance, and financial records, ensuring complete and regulator‑ready datasets.

Modeling & Calculation

We apply actuarial models, discount rates, and risk frameworks, ensuring accurate and regulator‑aligned valuations.

Compliance Validation

We verify valuations against SOCPA, IFRS, and Saudi regulations, ensuring audit‑ready documentation.

Ongoing Support

We provide advisory and updates, ensuring organizations remain compliant with evolving actuarial standards.

What Challenges Do Companies Face in Actuarial Valuation

Complex Regulatory Requirements

Saudi actuarial standards are evolving. MFD Services ensures valuations remain aligned with SOCPA and IFRS.

Data Gaps & Inconsistencies

Incomplete records delay valuations. MFD Services designs workflows that ensure accurate, regulator‑ready datasets.

Investor Queries in GCC

Stakeholders demand transparency. MFD Services prepares structured reports that minimize clarifications.

Limited Awareness of Actuarial Standards

SMEs often lack expertise. MFD Services provides training and advisory, ensuring compliance with Saudi regulations.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Related Posts

Documents Required for Actuarial Valuation in Saudi Arabia

Accurate documentation is essential for compliance and regulator confidence. MFD Services ensures organizations prepare and maintain all required records to support valuation transparency.

- Employee benefit records

- Insurance policyholder data

- Pension scheme details

- Financial statements

- Compliance registers

Which Laws and Authorities Govern Actuarial Valuation in Saudi Arabia

Top Actuarial valuation in Saudi Arabia is governed by strict regulatory frameworks. MFD Services ensures organizations meet all requirements by aligning systems with national authorities.

- SOCPA Saudi Arabia – Sets accounting and actuarial standards

- IFRS Standards – Governs international financial reporting

- SAMA Saudi Arabia – Regulates insurance and solvency requirements

- Ministry of Commerce KSA – Oversees corporate compliance

Cost & Pricing Overview for Actuarial Valuation

Pricing depends on complexity, company size, and regulator requirements. MFD Services provides guidance on cost considerations.

- Company Size in Saudi Arabia – Larger firms require extensive valuations.

- Customization Depth in KSA – Tailored actuarial models add moderate costs.

- Integration Effort in GCC – Multi‑entity valuations increase preparation.

Technology & Tools Used in Actuarial Valuation

MFD Services uses trusted platforms to deliver secure, compliant valuations. Our technology stack ensures efficiency, transparency, and regulator‑aligned reporting.

Industries We Serve with Actuarial Valuation in Saudi Arabia

MFD Services provides customized Actuarial Valuation solutions in KSA across diverse industries.

Insurance & Reinsurance Saudi Arabia

Pension Funds & Employee Benefits KSA

Healthcare & Pharmaceuticals GCC

Finance & Banking Saudi Arabia

SMEs & Family Businesses KSA

Why Choose MFD Services for Actuarial Valuation

Partnering with MFD Services ensures expert Actuarial Valuation in Saudi Arabia that combines regulatory knowledge, licensed professionals, and modern tools to deliver accurate, audit‑ready documentation.

- Compliance with Saudi regulatory requirements

- Regulator‑ready, transparent valuations

- Integrated ERP and actuarial software solutions

- Customized services for industries

- Continuous advisory and support

Contact Us

Contact MFD Services for Actuarial Valuation in Saudi Arabia

MFD Services delivers best Actuarial Valuation Services in Saudi Arabia, ensuring compliance, transparency, and efficiency. We design, implement, and manage frameworks that align with Saudi laws and global standards. Schedule your consultation today to secure a customized Actuarial Valuation roadmap tailored to your business needs.

FAQ's

4–8 weeks depending on complexity and license type.

Penalties, regulator queries, and investor risks occur.

Yes, scalable solutions are available.

Yes, structured reports minimize clarifications.