Audit & Assurance Services in Saudi Arabia by MFD Services

What Are Audit & Assurance Services and Why They Matter

Accurate financial reporting and independent verification are vital for businesses to maintain trust with stakeholders. Professional Audit & Assurance Services in Saudi Arabia help ensure compliance, transparency, and regulator-ready financial statements across KSA.

MFD Services coordinates with licensed auditors and finance professionals to examine records, evaluate controls, and deliver reliable reports. Our structured approach guarantees accurate, traceable, and fully compliant audit outcomes.

What Types of Audit & Assurance Services Do Businesses Need

To maintain robust financial governance, MFD Services provides expert audit & assurance services in Saudi Arabia, including:

Statutory Audit

Independent examination of financial statements to ensure compliance with Saudi regulations and industry standards.

Internal Audit

Evaluates internal controls, risk management, and operational efficiency for enhanced organizational governance.

Compliance Audit

Checks alignment with ZATCA, SOCPA, and other regulatory requirements to prevent discrepancies and penalties.

Forensic Audit

Investigates discrepancies, fraud, or irregularities in financial records, providing evidence for legal and regulatory purposes.

Operational & Performance Audit

Reviews processes, operational performance, and resource utilization to improve efficiency and strategic decision-making.

What Are the Benefits of Coordinated Audit & Assurance

Engaging MFD Services ensures professional audit & assurance solutions in Saudi Arabia deliver measurable advantages:

- Regulatory Compliance: Aligns financial statements with SOCPA and ZATCA standards.

- Risk Mitigation: Identifies and reduces financial and operational risks proactively.

- Operational Transparency: Enhances confidence among stakeholders and investors through credible reporting.

- Improved Controls: Strengthens internal processes and corporate governance.

Compliance Timelines for Audit & Assurance Services in Saudi Arabia

Timely audits are essential for regulatory adherence. MFD Services helps businesses across KSA meet deadlines of audit & assurance while maintaining reliable records:

- Quarterly Internal Audits: Conducted within 15–25 days post-quarter-end to assess compliance and operational efficiency.

- Annual Statutory Audits: Completed 3–4 months after fiscal year-end for regulator-approved financial reporting.

- Specialized Compliance Checks: Scheduled as required for specific VAT, ZATCA, or internal control assessments.

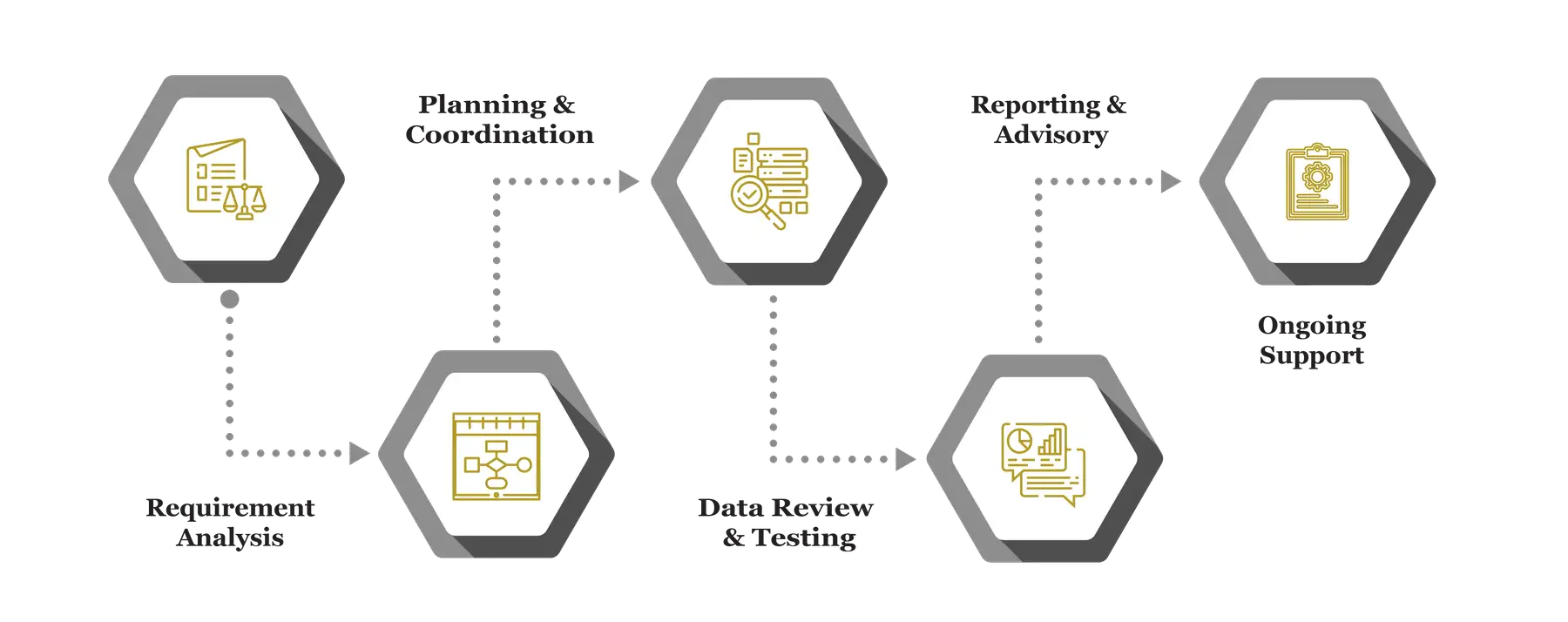

Our Process for Facilitating Audit & Assurance

MFD Services follows a structured approach to ensure accurate, reliable audits:

Requirement Analysis

We review current accounting practices, internal controls, and compliance gaps to design audit procedures customized for businesses in KSA, ensuring regulator-ready reports and minimized risk exposure.

Planning & Coordination

Licensed auditors coordinate schedules, access records, and communicate with internal teams to verify data, ensuring precise evaluation and full compliance with Saudi auditing standards.

Data Review & Testing

Transaction records, financial statements, and reconciliations are meticulously examined to detect errors, misstatements, or control weaknesses, supporting accurate, credible, and compliant audit outcomes.

Reporting & Advisory

Audit findings are compiled into detailed reports with actionable recommendations. MFD Services provides guidance for control improvements and risk mitigation to strengthen long-term compliance and operational efficiency.

Ongoing Support

Continuous advisory is offered to keep companies updated on evolving regulations, reporting requirements, and industry best practices, maintaining reliable and audit-ready financial systems.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

What Challenges Do Companies Face in Audit & Assurance

Businesses across KSA face challenges such as incomplete records, regulatory queries, and weak internal controls. MFD Services addresses these through structured audit procedures, documentation management, and proactive advisory support.

Incomplete Records

Missing ledgers, journals, or reconciliations delay audits and create compliance risks. We ensure complete, organized records for seamless regulator submission and internal validation.

Technical Errors

Misclassifications, calculation mistakes, or inconsistent entries can trigger penalties. Our licensed auditors verify all data, implement controls, and correct discrepancies, ensuring fully compliant and reliable financial reporting.

Regulator Queries

Authorities may request clarifications or additional evidence, slowing processes. MFD Services prepares structured responses, maintains comprehensive records, and minimizes follow-ups while ensuring full compliance.

Limited Awareness

Evolving regulations pose challenges for companies. Continuous advisory and training from MFD Services keep organizations informed of SOCPA, ZATCA, and corporate governance standards.

Contact Us

Documents Required for Audit & Assurance in Saudi Arabia

To conduct effective audits, businesses should maintain accurate and organized records. MFD Services advises clients to prepare the following:

Statutory financial statements

Ledgers and journals

VAT and tax filings

Bank statements and reconciliations

Internal control records & governance documents

Which Laws and Authorities Govern Audit in Saudi Arabia

Best Audit & Assurance in KSA require adherence to strict regulatory frameworks. MFD Services ensures compliance with:

SOCPA – Auditing standards and oversight

ZATCA – Tax alignment and compliance

Ministry of Commerce – Corporate reporting requirements

Capital Market Authority – Listed company audit rules

Cost & Pricing Overview for Audit & Assurance

Pricing depends on organizational complexity and audit scope. MFD Services provides guidance based on:

Company size and industry sector

Audit type and reporting depth

Internal control and compliance assessment requirements

Documentation volume and review complexity

Technology & Tools Used in Audit Coordination

MFD Services coordinates the use of trusted audit tools to ensure precise and compliant reporting:

Industries We Serve with Audit & Assurance in Saudi Arabia

MFD Services provides tailored audit solutions for sector-specific requirements:

Manufacturing & Industrial – Process compliance and statutory audits.

Real Estate & Construction – Project accounting and internal control evaluation.

Retail & E-Commerce – Transaction verification and VAT audit readiness.

Healthcare & Pharmaceuticals – Accurate expense tracking and compliance.

Financial & Banking – Comprehensive audits and risk mitigation.

Why Choose MFD Services for Audit & Assurance

Partnering with MFD Services ensures reliable, independent audits with structured processes of top audit & assurance services in KSA:

Coordination with licensed professionals

Transparent, regulator-ready documentation

Industry-specific audit expertise in Saudi Arabia

Structured processes for efficient audits

Ongoing advisory and compliance support

Contact MFD Services for Audit & Assurance in Saudi Arabia

Professional Audit & Assurance Services in KSA ensure compliance, transparency, and operational confidence. MFD Services coordinates licensed auditors, prepares regulator-ready documentation, and supports accurate reporting. Schedule a consultation for a customized audit plan today.

Related Posts

FAQ's

Typically 4–8 weeks depending on company size and audit scope.

Yes, MFD Services provides scalable, sector-specific audits for small and medium businesses.

Comprehensive reports with recommendations are provided for compliance, internal controls, and operational improvements.

Yes, all documentation and reporting adhere to SOCPA, ZATCA, and corporate governance requirements.

Yes, continuous advisory ensures updated compliance, risk mitigation, and process improvements.