Cash to Accrual Accounting Services in Saudi Arabia by MFD Services

What Are Cash to Accrual Accounting Services and Why They Matter

Best Accrual Accounting Services in Saudi Arabia help businesses transition from cash-based accounting to accrual-based accounting, providing a clearer picture of financial performance and obligations. Expert Cash to Accrual Accounting services ensure compliance, accurate reporting, and better decision-making for companies across KSA.

MFD Services works closely with licensed accountants to manage adjustments, reconciliations, and reporting processes. Our team ensures all financial statements are accurate, regulator-ready, and aligned with ZATCA and SOCPA requirements.

What Types of Cash to Accrual Accounting Services Do Businesses Need

To support a smooth transition, MFD Services provides expert services in Saudi Arabia, including:

Adjustment of Financial Statements – Converting cash-based records into accrual accounting format for accurate reporting.

Accounts Receivable and Payable Management – Recording income and expenses when earned or incurred, rather than when cash is exchanged.

Revenue and Expense Recognition – Ensuring proper alignment with accrual accounting principles and regulatory standards.

Reconciliation of Accounts – Verifying balances and ensuring accuracy between old cash records and new accrual statements.

Reporting and Advisory – Providing guidance on financial reporting and regulatory compliance after conversion.

What Are the Benefits of Cash to Accrual Accounting

Engaging MFD Services ensures top cash to accrual accounting services in Saudi Arabia deliver tangible advantages:

Accurate Financial Insight: Provides a true reflection of income, expenses, and liabilities.

Regulatory Compliance: Aligns reporting with ZATCA, SOCPA, and IFRS principles.

Improved Decision Making: Facilitates better planning and financial forecasting.

Investor Confidence: Transparent, regulator-ready records strengthen credibility with stakeholders.

Compliance Timelines for Cash to Accrual Accounting Services in Saudi Arabia

Timely and accurate accounting conversion is critical for compliance. MFD Services helps businesses across KSA manage deadlines and maintain proper records:

Financial Statement Conversion: Completed within 4–6 weeks depending on company size and existing records.

Accounts Reconciliation: Delivered alongside conversion to ensure accurate balances.

Revenue and Expense Adjustment: Applied immediately after conversion to maintain correct reporting.

Ongoing Advisory: Continuous support to maintain compliance with evolving accounting standards.

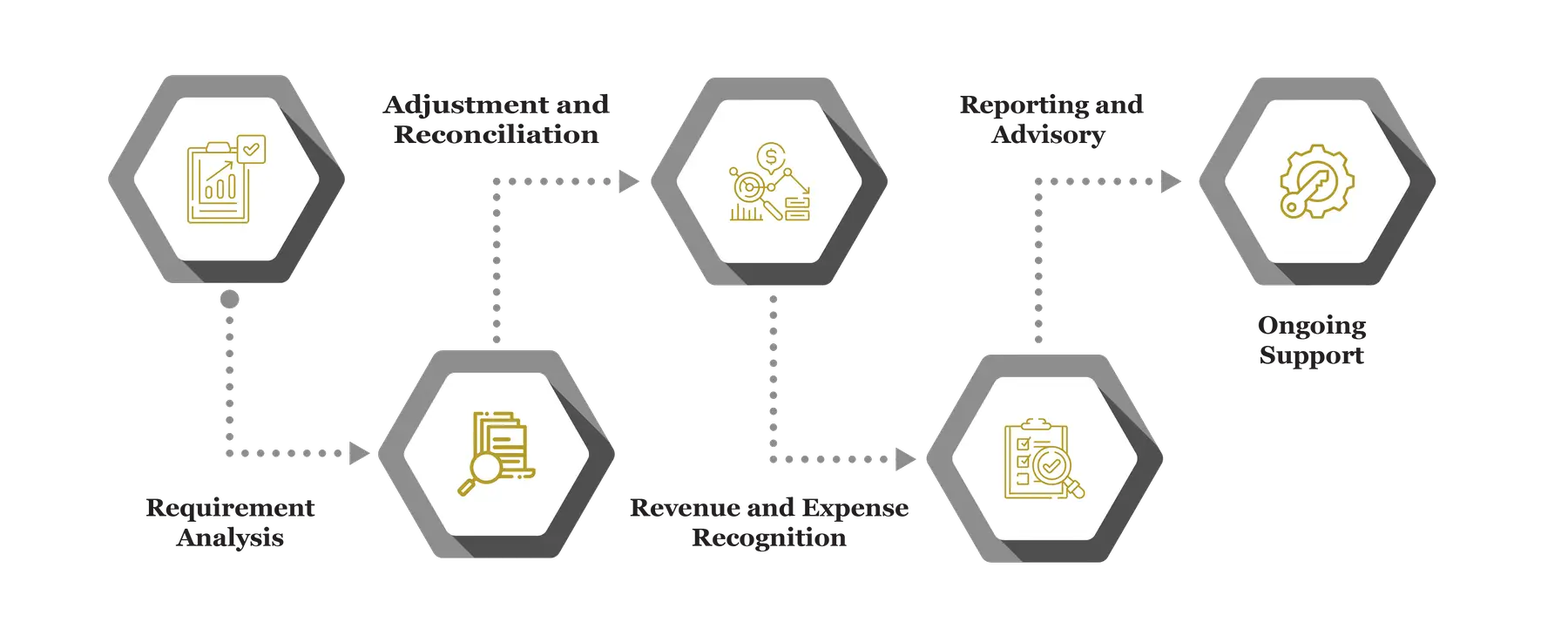

Our Process for Facilitating Cash to Accrual Accounting

MFD Services follows a structured approach to deliver expert cash to accrual accounting services in Saudi Arabia:

Requirement Analysis

We review existing cash-based records, identify gaps, and design a conversion roadmap. MFD Services ensures accurate financial reporting and audit readiness throughout the transition process.

Adjustment and Reconciliation

Existing transactions are adjusted to accrual standards. Our team reconciles accounts, verifies balances, and ensures all financial statements are accurate and compliant with regulatory requirements.

Revenue and Expense Recognition

MFD Services ensures that income and expenses are recognized in the correct period, aligning with accrual accounting principles and providing reliable financial statements for internal and external stakeholders.

Reporting and Advisory

We provide detailed reports and advisory on accrual accounting best practices. MFD Services guides businesses on maintaining compliance, improving transparency, and facilitating better financial decision-making.

Ongoing Support

Continuous guidance ensures businesses remain compliant with ZATCA, SOCPA, and other applicable standards. MFD Services provides updates and support to maintain accuracy and regulatory alignment.

What Challenges Do Companies Face in Cash to Accrual Accounting

Businesses in Saudi Arabia often face hurdles when converting from cash to accrual accounting. MFD Services addresses these challenges through structured solutions:

Incomplete Records

Missing or inconsistent cash records can delay conversion. MFD Services organizes and validates all data to ensure a seamless transition and accurate financial reporting.

Technical Errors

Incorrect entries or misclassified transactions can result in inaccurate accrual statements. Our licensed accountants verify all adjustments to deliver reliable, compliant financial statements.

Regulatory Compliance

Transitioning requires alignment with ZATCA, SOCPA, and IFRS standards. MFD Services ensures all processes and reports meet regulatory requirements to reduce risks of penalties.

Skill Gaps

Finance teams may lack experience with accrual accounting. MFD Services provides training and guidance to equip teams with the knowledge to maintain accurate records and ongoing compliance.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Cash to Accrual Accounting in Saudi Arabia

To ensure smooth transition and compliance, MFD Services advises businesses to maintain:

- Historical cash-based financial statements

- Bank statements and reconciliations

- Accounts receivable and payable records

- Payroll and HR documentation

- Contracts and operational agreements

- Audit trails and supporting documentation

Which Laws and Authorities Govern Cash to Accrual Accounting in Saudi Arabia

Best Cash to accrual accounting must comply with local regulations. MFD Services ensures your business meets requirements of:

- ZATCA – VAT compliance and financial reporting

- SOCPA – Accounting standards and auditor licensing

- Ministry of Commerce (MoC) – Corporate filings and governance

- National Cybersecurity Authority – Secure handling of financial data

Cost & Pricing Overview for Cash to Accrual Accounting

Pricing depends on business size and complexity. MFD Services provides guidance on cost considerations:

- Company Size: Larger organizations require more extensive adjustments and reconciliations.

- Complexity: Multiple revenue streams or subsidiaries may increase preparation effort.

- Customization: Customised reporting and advisory may slightly adjust costs.

Technology & Tools Used in Cash to Accrual Accounting

MFD Services leverages reliable accounting tools to ensure accurate and compliant financial records:

Industries We Serve with Cash to Accrual Accounting in Saudi Arabia

MFD Services provides specialized support for a range of sectors, including:

Retail & E-Commerce – Accurate revenue and expense reporting

Healthcare & Pharmaceuticals – Compliance with expense recognition standards

Real Estate & Construction – Project accounting and cash flow adjustments

Finance & Banking – Reliable accrual-based financial statements

SMEs & Family-Owned Businesses – Scalable and efficient transition solutions

Why Choose MFD Services for Cash to Accrual Accounting

Partnering with MFD Services ensures expert cash to accrual accounting services in Saudi Arabia, combining regulatory knowledge, licensed professionals, and modern tools:

- Licensed accountants and financial experts

- Transparent, regulator-ready documentation

- Customised solutions for company size and industry

- ERP and cloud integration for efficiency

- Continuous advisory and support

Contact Us

Contact MFD Services for Cash to Accrual Accounting in Saudi Arabia

Professional Cash to Accrual Accounting Services in KSA ensure compliance, transparency, and operational efficiency. MFD Services coordinates licensed experts, converts financial records accurately, and delivers audit-ready reporting. Schedule your consultation today.

FAQ's

Typically 4–6 weeks depending on company size and existing records.

Yes, MFD Services offers scalable solutions for small and medium-sized businesses.

Yes, we provide practical guidance and training to ensure accurate application.

Yes, MFD Services ensures all converted records meet ZATCA and SOCPA requirements.

Continuous advisory and updates help businesses remain compliant with accounting standards in Saudi Arabia.