Accounting & Bookkeeping Services in Saudi Arabia by MFD Services

What Are Accounting & Bookkeeping Services and Why They Matter

Accurate financial management depends on expert recording, reconciliation, and reporting of transactions. Professional Accounting & Bookkeeping Services in Saudi Arabia ensure transparency, compliance with ZATCA and SOCPA, and audit-ready financial statements for businesses in KSA.

MFD Services works closely with licensed accountants and compliance professionals to manage documentation, reconciliations, reporting, and filings. Our top-tier team ensures records are accurate, traceable, and fully regulator-ready.

What Types of Accounting & Bookkeeping Services Do Businesses Need

To maintain robust financial operations, MFD Services provides expert services in Saudi Arabia, including:

Monthly Bookkeeping

Maintaining ledgers, VAT-aligned entries, and reconciliations for accurate daily records.

Financial Statement Preparation

Preparing balance sheets, income statements, and cash flow reports aligned with regulatory standards.

Accounts Payable & Receivable Management

Tracking vendor payments, collections, and invoices for smooth cash flow.

Bank Reconciliation

Verifying that financial records match bank statements to avoid discrepancies.

Cloud Accounting Setup

Implementing QuickBooks, Zoho Books, SAP, or Odoo ERP for efficient, compliance-ready reporting.

What Are the Benefits of Coordinated Accounting & Bookkeeping

Engaging MFD Services ensures top accounting and bookkeeping solutions in Saudi Arabia deliver measurable advantages:

- Regulatory Compliance: Ensures all records align with ZATCA and SOCPA requirements.

- Reduced Risk of Penalties: Accurate documentation prevents fines and audit issues.

- Operational Efficiency: Streamlined reconciliations and reporting save valuable time.

- Investor Confidence: Transparent, regulator-ready records build credibility with stakeholders.

Compliance Timelines for Accounting & Bookkeeping Services in Saudi Arabia

Timely accounting and bookkeeping are crucial for regulatory compliance. MFD Services helps businesses across KSA meet deadlines while maintaining accurate financial records:

- Monthly Bookkeeping & Reconciliations: Completed within 15–20 days each month, ensuring VAT compliance and transaction accuracy.

- Quarterly Financial Reporting: Prepared within 30–45 days after the quarter-end, aligned with SOCPA and ZATCA requirements.

- Annual Accounts & Statutory Filings: Delivered 3–4 months after fiscal year-end, covering audits, financial statements, and corporate reporting.

- Payroll & Tax Compliance: Scheduled monthly or quarterly depending on company size, ensuring timely submission and regulator adherence.

MFD Services provides detailed project schedules and milestone tracking, helping companies plan effectively, avoid penalties, and maintain fully compliant and audit-ready records.

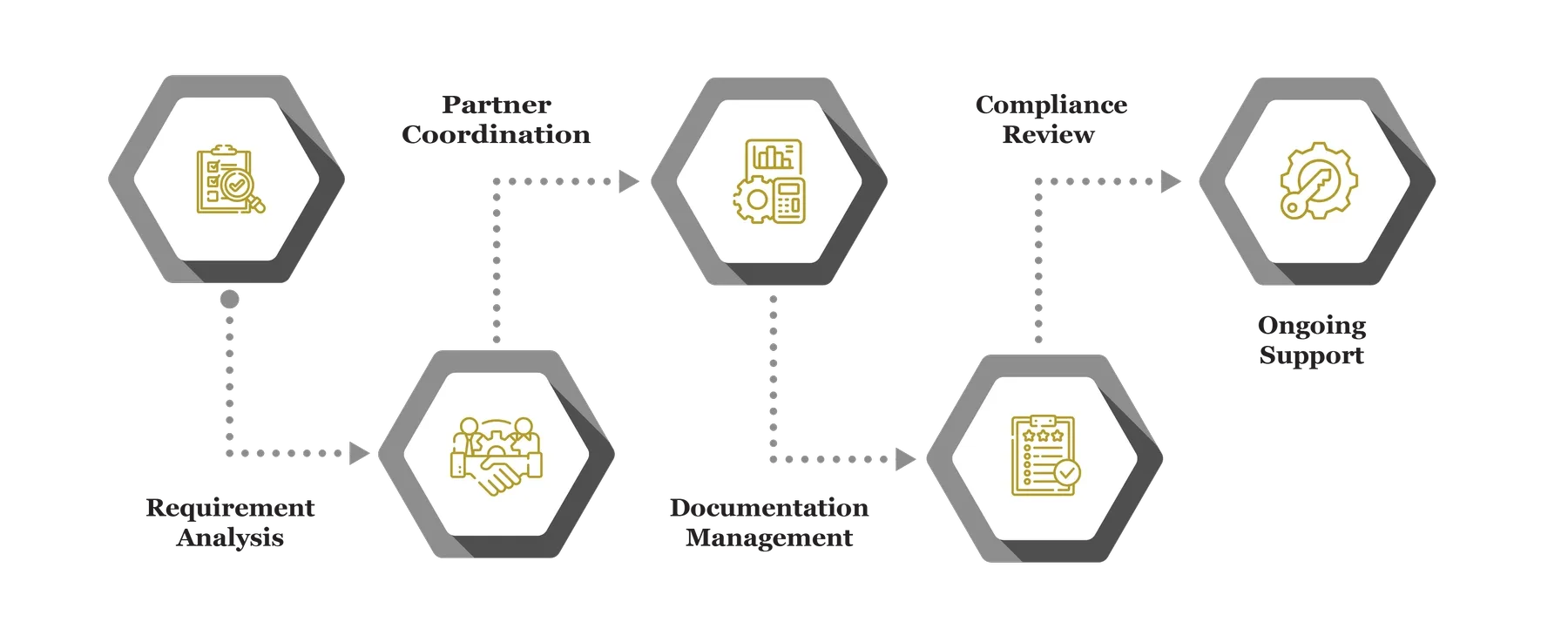

Our Process for Facilitating Accounting & Bookkeeping

MFD Services follows a structured approach to deliver expert financial management in ensuring accuracy and regulatory compliance:

Requirement Analysis

We conduct a thorough review of existing accounting practices, identify gaps in reporting and compliance, and design workflows customised for businesses in KSA. This ensures accurate financial reporting aligned with Saudi regulations and audit readiness.

Partner Coordination

Licensed accountants and finance specialists coordinate reconciliations, reporting, and documentation with precision. MFD Services ensures that every entry is verified, reducing errors, streamlining processes, and supporting full compliance with ZATCA, SOCPA, and other regulatory authorities in Saudi Arabia.

Documentation Management

All financial records are systematically organized and categorized to guarantee clarity, traceability, and transparency. Our approach ensures businesses in Saudi Arabia maintain audit-ready documentation while allowing seamless access for regulators, internal teams, and stakeholders whenever required.

Compliance Review

Financial statements, reconciliations, and reports are carefully verified against ZATCA and SOCPA standards. MFD Services validates classifications, ensures regulator alignment, and identifies potential discrepancies to mitigate risks while maintaining reliable, compliant records.

Ongoing Support

Continuous advisory is provided to keep companies up to date with evolving financial regulations. We offer guidance on updates, best practices, and compliance improvements, helping businesses maintain operational efficiency and long-term confidence in their accounting systems.

Accounting & Bookkeeping Services We Offer

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

What Challenges Do Companies Face in Accounting & Bookkeeping

Businesses across KSA often face challenges such as incomplete records, technical errors, frequent regulator queries, and limited awareness of compliance requirements. MFD Services addresses these issues through structured documentation, accurate reconciliations, and proactive advisory support, ensuring audit-ready, regulator-compliant financial systems.

Incomplete Records

Missing invoices, ledger entries, or reconciliations can delay reporting and trigger compliance risks. We prepare complete and organized financial records, ensuring clarity, transparency, and seamless submission for regulators, investors, and internal audit purposes.

Technical Errors

Misclassified transactions, calculation mistakes, or inconsistent entries can lead to penalties. Our licensed accountants verify every entry for accuracy, correct discrepancies, and implement controls, providing reliable, error-free, and fully compliant accounting records for businesses in Saudi Arabia.

Regulator Queries

Authorities may request clarifications or additional documentation, slowing operations. MFD Services prepares structured responses, maintains thorough records, and implements compliance-ready processes, minimizing regulator follow-ups while ensuring companies meet all Saudi reporting and audit obligations efficiently.

Limited Awareness

Rapidly evolving regulations and accounting standards create risks for companies. We provide training, updates, and ongoing advisory to ensure businesses across KSA remain aware of ZATCA, SOCPA, and other compliance requirements, reducing errors and regulatory exposure.

Contact Us

Documents Required for Accounting & Bookkeeping in Saudi Arabia

To ensure compliance, businesses should maintain accurate records. MFD Services advises clients to prepare and maintain:

- VAT invoices and reconciliations

- Financial statements and ledgers

- Payroll and HR records

- Contracts and governance documents

- Compliance registers and audit trails

Which Laws and Authorities Govern Accounting in Saudi Arabia

Accounting & bookkeeping in KSA require adherence to strict regulations. MFD Services ensures your business meets the following authorities’ requirements:

- ZATCA – VAT compliance and reconciliations

- SOCPA – Accounting standards and auditor licensing

- Ministry of Commerce (MoC) – Statutory filings and corporate governance

- National Cybersecurity Authority – Secure handling of financial data

Cost & Pricing Overview for Accounting & Bookkeeping

Pricing depends on complexity and company needs. MFD Services provides guidance on cost considerations:

- Company Size: Larger firms need extensive setups; SMEs have simpler requirements.

- Customization Depth: Customised workflows enhance efficiency with moderate cost adjustments.

- Integration Effort: ERP or cloud accounting integration increases preparation requirements.

Technology & Tools Used in Accounting Coordination

MFD Services coordinates the use of trusted accounting tools to deliver accurate and compliant records:

Industries We Serve with Accounting & Bookkeeping in Saudi Arabia

Financial management challenges differ by industry. MFD Services provides customised support to meet sector-specific compliance and reporting needs:

Retail & E-Commerce – VAT, transaction management, and reconciliations.

Healthcare & Pharmaceuticals – Accurate tracking of expenses and compliance reporting.

Real Estate & Construction – Project accounting and cash flow control.

Finance & Banking – Precise reporting and audit readiness.

SMEs & Family-Owned Businesses – Scalable and efficient bookkeeping solutions.

Why Choose MFD Services for Accounting & Bookkeeping

Partnering with MFD Services ensures expert accounting services in KSA that combine regulatory knowledge, licensed professionals, and modern tools to deliver accurate, audit-ready financial reporting.

- Compliance with Saudi regulatory requirements

- Regulator-ready, transparent documentation

- Integrated ERP and cloud solutions for efficiency

- Customized services for industries and company size

- Continuous advisory and support

Contact MFD Services for Accounting & Bookkeeping in Saudi Arabia

Professional Accounting & Bookkeeping Services in KSA ensure compliance, transparency, and operational efficiency. MFD Services coordinates licensed experts, prepares regulator-ready documentation, and supports accurate reporting. Schedule your consultation for a customized compliance checklist today.

FAQ's

How long does setup take?

Typically 4–8 weeks depending on company size and documentation maturity.

What happens if compliance is delayed?

Delays may lead to penalties, regulator queries, or reputational risks.

Can SMEs benefit from professional services?

Yes, scalable and customised accounting solutions are available for small and medium businesses.

Does proper documentation reduce regulator queries?

Yes, thorough and structured records minimize audit clarifications.

Are acknowledgment receipts issued after filing?

Yes, regulators provide confirmation of submission.