Cash Count Assignment in Saudi Arabia by MFD Services

What Is Cash Count Assignment and Why It Matters

Accurate cash management is essential for operational efficiency and financial integrity. Professional Cash Count Assignment services in Saudi Arabia ensure that all cash on hand is verified, recorded, and reconciled correctly, reducing discrepancies and improving transparency.

MFD Services works with top finance professionals to conduct systematic cash counts, reconcile differences, and maintain organized records. Our expert team guarantees accuracy, compliance, and audit-ready documentation for businesses across KSA.

What Types of Cash Count Assignment Services Do Businesses Need

To maintain reliable financial operations, MFD Services provides expert cash count assignment solutions in Saudi Arabia, including:

- Daily Cash Verification – Counting and validating cash balances to ensure accurate records.

- Petty Cash Management – Monitoring small cash expenses and replenishments.

- Cash Reconciliation – Comparing physical cash with ledger balances to identify discrepancies.

- Branch and Department Cash Counts – Performing independent verification at multiple locations for large organizations.

- Cash Handling Controls – Implementing processes to prevent fraud or errors.

Benefits of Professional Cash Count Assignments

Engaging MFD Services ensures top cash count assignment solutions in Saudi Arabia deliver:

- Accuracy: Reduces errors in cash balances and financial reporting.

- Regulatory Compliance: Ensures records are aligned with SOCPA and internal audit standards.

- Operational Efficiency: Streamlined cash handling and verification save time and resources.

- Fraud Prevention: Transparent processes mitigate the risk of misappropriation or mismanagement.

Compliance Timelines for Cash Count Assignment

Timely cash verification is crucial for operational and regulatory compliance. MFD Services helps businesses across KSA meet schedules while maintaining accurate financial control:

- Daily Cash Checks: Conducted at the start or end of each business day.

- Weekly Reconciliations: Summaries prepared and verified within 3–5 days after week-end.

- Monthly Audit Reports: Completed within 10–15 days to ensure internal and regulator review readiness.

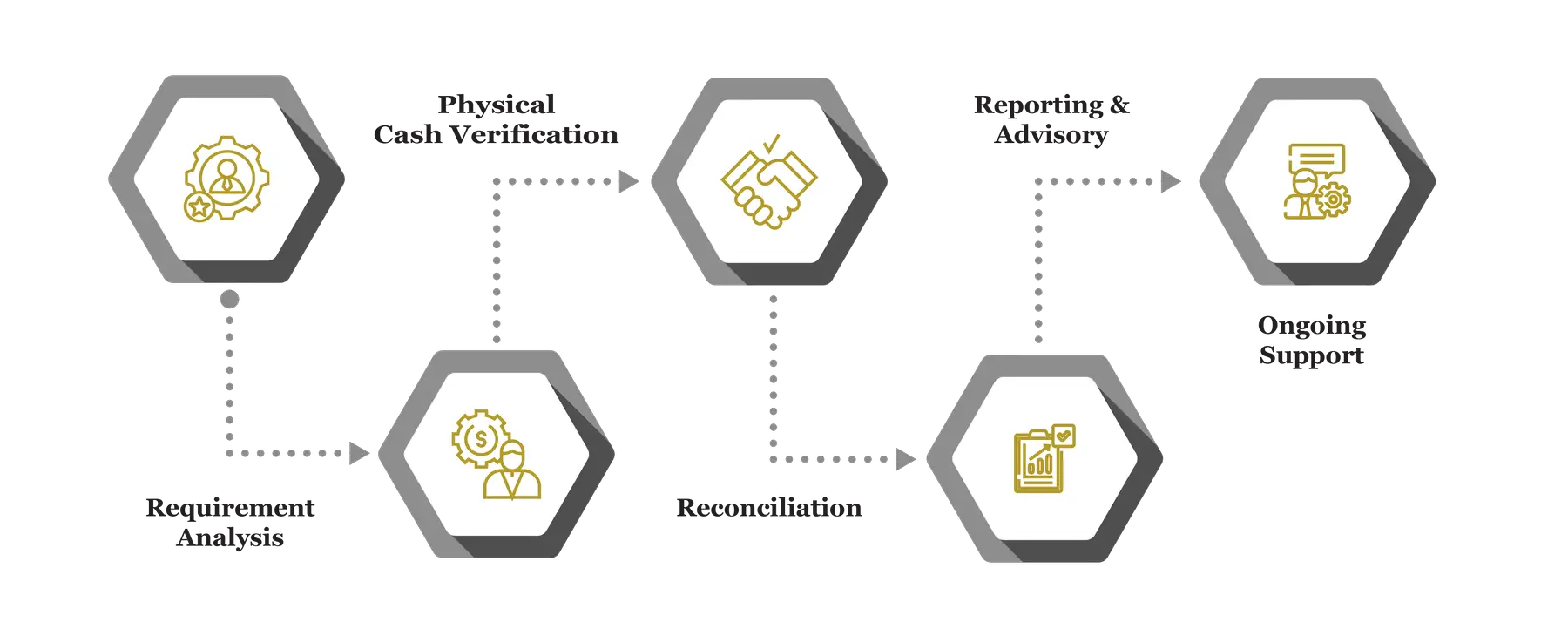

Our Process for Cash Count Assignment

MFD Services follows a structured approach to deliver professional cash count assignment services in Saudi Arabia:

- Requirement Analysis

We review existing cash handling processes, identify risks, and design workflows tailored for compliance and accuracy. - Physical Cash Verification

Our experts conduct meticulous cash counts at designated locations to ensure alignment with records. - Reconciliation

Cash balances are compared with ledger entries, discrepancies are investigated, and corrective actions are implemented. - Reporting & Advisory

Detailed reports and insights are shared with management, providing recommendations for improved cash handling practices. - Ongoing Support

Continuous monitoring and advisory services ensure cash processes remain secure, efficient, and compliant.

Common Challenges and How MFD Services Solves Them

Businesses often face cash management challenges. MFD Services addresses these effectively:

- Discrepancies in Cash Records: Physical counts often differ from ledger balances. Our experts reconcile differences quickly and accurately.

- Fraud Risks: Unmonitored cash handling can lead to misappropriation. MFD Services implements controls to safeguard assets.

- Inconsistent Processes: Multiple departments or branches may follow varied procedures. We standardize cash count processes for uniformity.

- Limited Staff Expertise: Staff may lack knowledge in cash verification standards. Our professionals provide training and ongoing support.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Cash Count Assignment in Saudi Arabia

To ensure accuracy and compliance, MFD Services advises businesses to maintain:

- Cash ledgers and journals

- Bank deposit slips and withdrawal records

- Petty cash vouchers and receipts

- Previous reconciliation reports

- Internal audit checklists

Which Laws and Authorities Govern Cash Management in Saudi Arabia

Best cash count assignment services in Saudi Arabia must comply with regulations and internal controls. MFD Services ensures adherence to:

- SOCPA – Accounting standards and audit readiness

- Ministry of Commerce (MoC) – Corporate governance

- Internal Audit Authorities – Fraud prevention and compliance verification

- National Cybersecurity Authority – Secure handling of financial data

Cost & Pricing Overview

Pricing depends on business size, number of locations, and complexity. MFD Services provides guidance:

- Company Size: Larger operations require more extensive cash counts.

- Branches/Departments: Multi-location verification increases effort.

- Customization: Additional controls, reporting, or advisory slightly adjust costs.

Industries We Serve with Cash Count Assignment

MFD Services provides professional cash verification across sectors:

- Retail & E-Commerce – Daily store and warehouse cash verification

- Banking & Finance – Branch cash reconciliation and reporting

- Hospitality & Restaurants – Petty cash and operational cash audits

- Real Estate & Construction – Project site cash management

- SMEs & Family-Owned Businesses – Efficient and scalable cash handling solutions

Why Choose MFD Services

Partnering with MFD Services ensures top-quality cash management services in Saudi Arabia:

- Licensed finance and accounting professionals

- Accurate, regulator-ready documentation

- Customized processes for each business and branch

- Fraud prevention and operational efficiency

- Continuous advisory and support

Contact Us

Contact MFD Services for Cash Count Assignment in Saudi Arabia

Professional Cash Count Assignment services in KSA ensure accuracy, compliance, and operational efficiency. MFD Services coordinates licensed experts, reconciles records, and provides actionable insights to strengthen financial control. Schedule your consultation today.

FAQs: Cash Count Assignment in Saudi Arabia

Daily for operational cash and weekly for reconciliations; monthly reports ensure audit readiness.

Yes, our solutions are scalable and tailored to company size and complexity.

Yes, we implement controls, verify balances, and provide advisory to minimize risks.

Yes, detailed reports are provided for management review and audit compliance.

Continuous advisory, monitoring, and training are provided for long-term cash process efficiency.