Top CFO Services in Saudi Arabia by MFD Services

What Are CFO Services and Why They Matter

Chief Financial Officer (CFO) services provide strategic financial leadership, enabling businesses to optimize cash flow, drive growth, and ensure regulatory compliance. Professional CFO services in Saudi Arabia guide companies in budgeting, forecasting, and risk management, crucial for decision-making in KSA.

MFD Services collaborates with licensed finance experts and advisory professionals to manage financial planning, reporting, and strategic guidance. Our team delivers top-tier solutions, ensuring governance, accuracy, and regulator-ready financial oversight for businesses across Saudi Arabia.

What Types of CFO Services Do Businesses Need in Saudi Arabia

MFD Services provides expert CFO services in KSA, covering a range of strategic and operational financial needs:

Financial Strategy & Planning

Developing long-term budgets, forecasts, and financial roadmaps aligned with corporate goals.

Cash Flow Management

Monitoring inflows and outflows to maintain liquidity, optimize working capital, and reduce financial risk.

Risk Assessment & Compliance

Evaluating regulatory, market, and operational risks; ensuring adherence to ZATCA and SOCPA standards.

Investor & Stakeholder Reporting

Preparing board-ready financial reports, KPI dashboards, and investor presentations for transparency and trust.

Mergers & Acquisitions Support

Providing financial due diligence, valuation, and integration guidance for corporate transactions.

ERP & Financial Systems Integration

Implementing accounting and reporting tools like SAP, Oracle NetSuite, and Odoo ERP for efficient management and compliance.

What Are the Benefits of Best CFO Services

Engaging MFD Services ensures top CFO solutions in Saudi Arabia deliver measurable advantages:

- Strategic Decision-Making: Data-driven insights support business growth.

- Regulatory Compliance: Adherence to ZATCA, SOCPA, and local financial rules.

- Financial Efficiency: Optimized cash flow and cost management reduce operational waste.

- Investor Confidence: Transparent reporting builds credibility with stakeholders and partners.

Compliance Timelines for CFO Services in Saudi Arabia

Strategic financial oversight requires timely execution of CFO responsibilities. MFD Services ensures businesses across KSA meet all reporting deadlines while maintaining compliance with ZATCA, SOCPA, and corporate governance requirements.

- Monthly Financial Oversight: Cash flow, budgeting, and variance analysis delivered within the first 10 business days of each month.

- Quarterly Performance Reporting: Financial and operational reports prepared to guide strategic decisions and regulatory adherence.

- Annual Budgeting & Forecasting: Completed before fiscal year-end to align planning with company objectives and compliance obligations.

- Regulatory Filings & Compliance Reviews: Scheduled according to local timelines to prevent penalties and maintain governance standards.

Our Proffessional CFO Services provides clear project milestones and structured timelines, ensuring businesses operate efficiently, stay compliant, and achieve strategic financial goals.

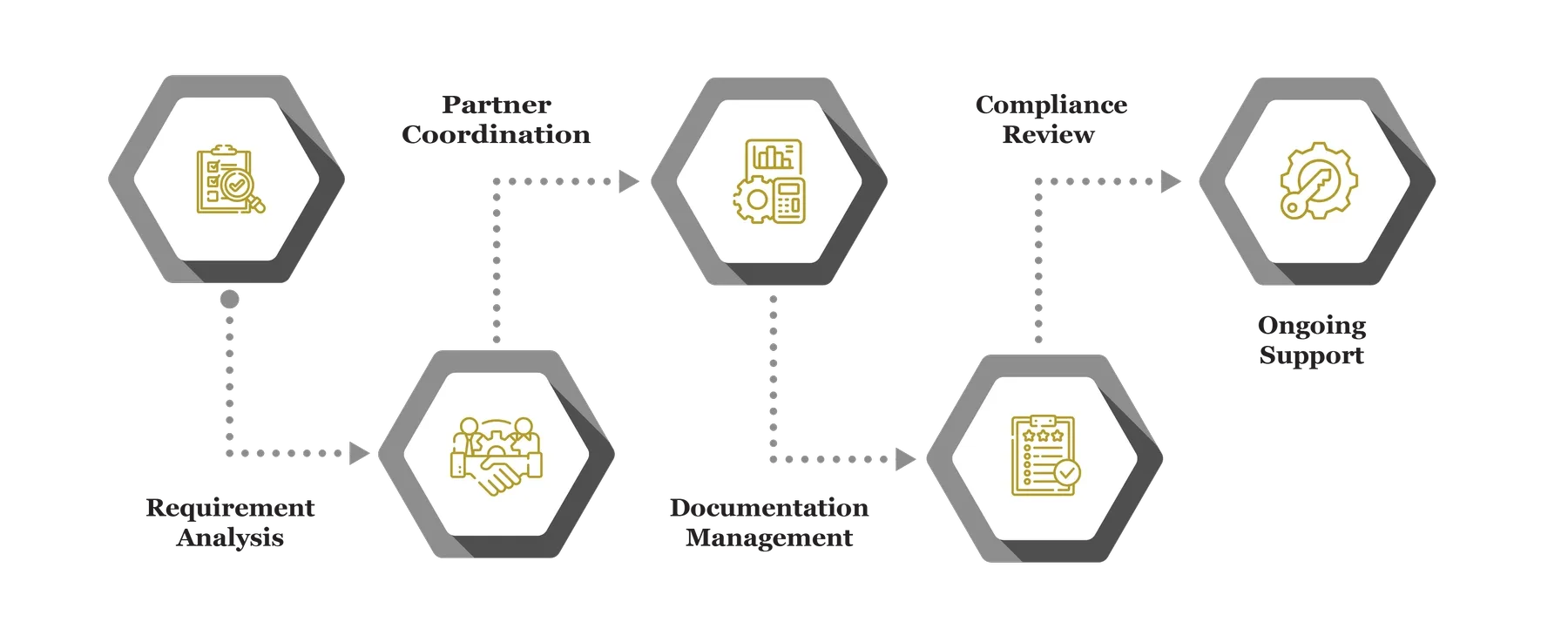

Our Process for Facilitating CFO Solutions in Saudi Arabia

MFD Services follows a structured approach to deliver reliable, professional CFO services in KSA, ensuring strategic guidance and compliance:

Requirement Analysis

We assess financial processes, current reporting, and business objectives to define CFO service scope and alignment with KSA regulations.

Partner Coordination

Licensed finance experts execute planning, reporting, and compliance tasks, ensuring top-quality, regulator-ready outputs.

Documentation Management

Financial data, forecasts, and dashboards are organized for clarity, traceability, and board-ready presentation.

Compliance Review

Reports and financial strategies are validated against local regulations to prevent errors and regulatory issues.

Ongoing Advisory & Support

Continuous monitoring, updates, and strategic guidance ensure sustained compliance, accurate reporting, and proactive business decisions.

What Challenges Do Companies Face in CFO Services

Businesses often lack in-house expertise to manage strategic finance, compliance, and reporting. Without professional CFO solutions in Saudi Arabia, companies risk misaligned budgets, regulatory penalties, and poor stakeholder communication. MFD Services solves these challenges by providing structured planning and licensed financial expertise.

Limited Strategic Insight

Companies struggle to align financial goals with business objectives. We provide actionable analysis, forecasts, and KPI tracking to drive informed decisions and operational efficiency.

Cash Flow Inefficiency

Poor management of receivables, payables, and liquidity increases risk. We implement monitoring systems and optimization strategies, ensuring timely cash flow and financial stability.

Regulatory Compliance Risks

Incomplete or inaccurate reporting may trigger penalties. Our licensed experts validate reports and maintain regulator-ready documentation, minimizing compliance issues.

Stakeholder Communication Gaps

Unclear reporting reduces investor trust. We prepare structured financial reports, dashboards, and presentations to improve clarity and strengthen credibility.

Documents Required for Professional CFO Services in Saudi Arabia

To ensure effective financial management and compliance, businesses should maintain comprehensive records. MFD Services helps companies across KSA organize and review all necessary documentation:

- Historical financial statements and ledgers

- Budgets, forecasts, and strategic plans

- Cash flow and working capital reports

- Compliance filings and audit trails

- Contracts, leases, and investment agreements

Which Laws and Authorities Govern CFO Services in Saudi Arabia

Professional CFO solutions in Saudi Arabia operate under strict regulatory oversight. MFD Services ensures adherence to all relevant authorities for accurate and compliant financial leadership:

- ZATCA – VAT compliance and financial reporting

- SOCPA – Accounting standards and CFO-related regulations

- CMA – Financial disclosures and investor reporting for listed companies

- Ministry of Commerce (MoC) – Corporate governance and statutory filings

Cost & Pricing Overview for CFO Services

Costs for CFO services vary depending on company size, operational complexity, and integration requirements. MFD Services guides businesses across Saudi Arabia to plan budgets and manage expenses efficiently:

- Company Size: Larger corporations require more comprehensive services; SMEs have simpler scopes.

- Complexity of Operations: Multiple entities, divisions, or business lines increase planning effort.

- Integration Needs: ERP, reporting systems, and dashboards affect cost and implementation time.

Technology & Tools Used in CFO Coordination

MFD Services advantages trusted technology to deliver strategic, accurate, and compliant CFO services:

Industries We Serve with CFO Services in Saudi Arabia

Companies across sectors benefit from strategic financial leadership:

Retail & E-Commerce – Optimized pricing, margins, and reporting.

Healthcare & Pharmaceuticals – Financial planning and regulatory adherence.

Real Estate & Construction – Project budgeting and cash flow oversight.

Finance & Banking – Compliance reporting and investor transparency.

SMEs & Family-Owned Businesses – Scalable CFO solutions customised to growth and cash flow needs.

Why Choose MFD Services for CFO Services

MFD Services delivers expert CFO services in KSA combining licensed financial expertise, modern tools, and local compliance knowledge to strengthen business growth and investor confidence.

- Alignment with KSA regulations and corporate governance standards

- Regulator-ready, transparent reporting and financial strategies

- Integrated ERP and analytics tools for efficiency

- Customised solutions for company size and industry

- Continuous advisory and performance monitoring

Contact Us

Contact MFD Services for CFO Services in Saudi Arabia

Top CFO Services in KSA ensure strategic, regulator-aligned financial leadership. MFD Services coordinates licensed experts, provides accurate reporting, and supports informed decision-making. Schedule a consultation to receive a customized financial roadmap and compliance checklist today.

FAQ's

How long does CFO setup take?

Typically 6–10 weeks depending on company size, reporting complexity, and integration requirements.

Can SMEs access CFO solutions?

Yes, solutions are scalable, affordable, and customised to smaller businesses’ operational and financial needs.

Are these services compliant with Saudi regulations?

Absolutely, all reports and strategies follow ZATCA, SOCPA, and MoC requirements.

Does CFO advisory improve investor confidence?

Yes, accurate financial reporting and dashboards enhance transparency and stakeholder trust.

Is technology integrated into CFO services?

Yes, ERP, cloud accounting, and analytics tools streamline planning, reporting, and compliance.