IFRS Advisory & Implementation Services in Saudi Arabia by MFD Services

What Are IFRS Advisory & Implementation Services and Why They Matter

Accurate financial reporting depends on expert alignment with international accounting standards. Expert IFRS Advisory & Implementation Services in Saudi Arabia ensure transparency, compliance with ZATCA and SOCPA, and audit-ready financial statements for businesses in KSA.

MFD Services works closely with licensed accountants and IFRS specialists to manage assessment, policy development, financial statement conversion, and staff training. Our team ensures records are accurate, consistent, and fully regulator-ready.

What Types of IFRS Advisory & Implementation Services Do Businesses Need

To achieve seamless IFRS adoption, MFD Services provides expert services in Saudi Arabia, including:

- IFRS Gap Analysis – Evaluating existing accounting policies against IFRS standards to identify gaps and design a customised implementation roadmap.

- Policy & Standards Development – Creating IFRS-aligned accounting policies to ensure compliance, consistency, and operational efficiency.

- Financial Statement Conversion – Converting existing financial statements to IFRS standards for accuracy, transparency, and comparability.

- Training & Capacity Building – Equipping finance teams with practical IFRS knowledge and tools to maintain ongoing compliance.

- Implementation Support – Full assistance in IFRS adoption, including reconciliations, reporting templates, and stakeholder-ready disclosures.

What Are the Benefits of Coordinated IFRS Advisory & Implementation

Engaging MFD Services ensures top IFRS services in Saudi Arabia deliver measurable advantages:

- Regulatory Compliance: Aligns all financial reporting with ZATCA, SOCPA, and international IFRS standards.

- Reduced Risk of Penalties: Accurate IFRS adoption prevents fines and audit issues.

- Operational Efficiency: Streamlined policies, reconciliations, and reporting save valuable time.

- Investor Confidence: Transparent, regulator-ready IFRS statements build credibility with stakeholders.

Compliance Timelines for Professional IFRS Advisory & Implementation Services in Saudi Arabia

Timely IFRS adoption is crucial for regulatory compliance. MFD Services helps businesses across KSA meet deadlines while maintaining accurate and audit-ready financial records:

- IFRS Gap Analysis & Policy Design: Completed within 3–4 weeks depending on company size and existing accounting practices.

- Financial Statement Conversion: Delivered 6–8 weeks after initial assessment, ensuring full alignment with IFRS standards.

- Training & Capacity Building: Scheduled alongside implementation phases for smooth adoption.

- Ongoing Advisory & Support: Continuous guidance to maintain compliance with evolving IFRS regulations.

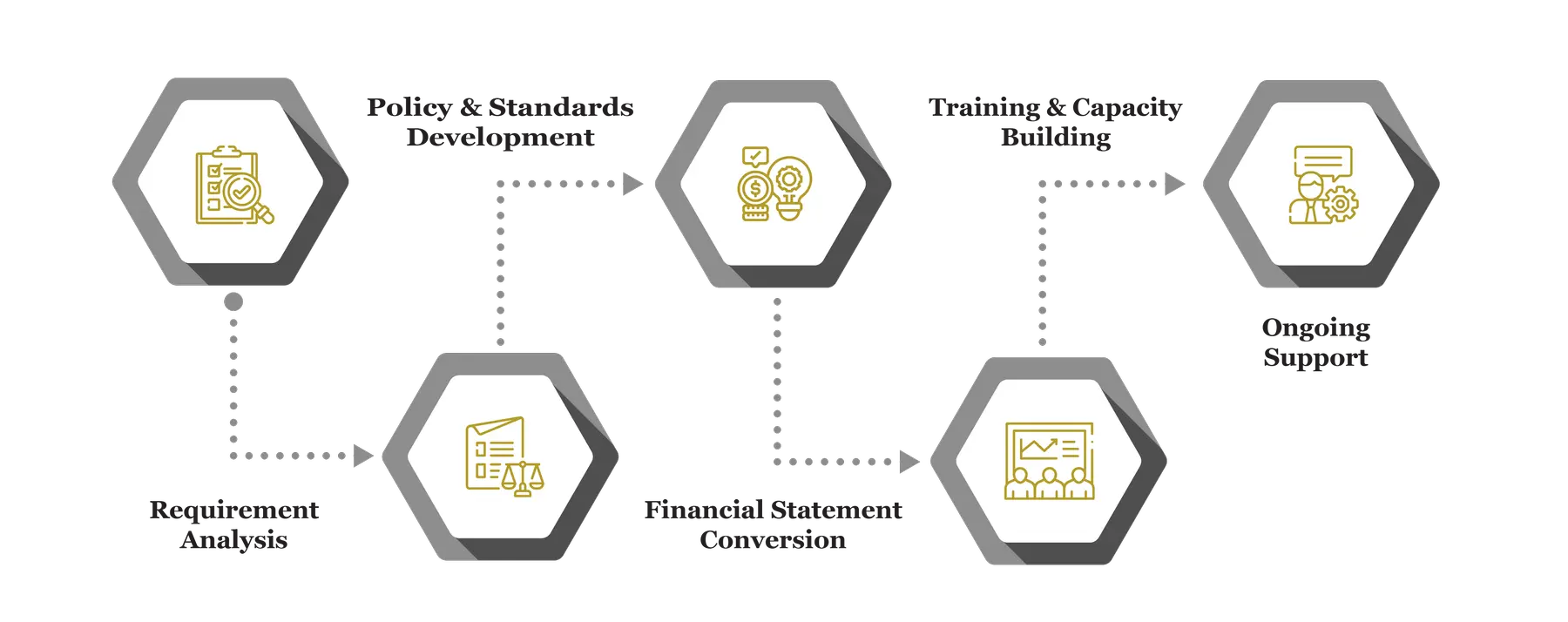

Our Process for Facilitating IFRS Advisory & Implementation

MFD Services follows a structured approach to deliver expert IFRS Services in Saudi Arabia:

Requirement Analysis

We review current accounting practices, identify gaps against IFRS standards, and design a transition roadmap. MFD Services ensures audit-ready, compliant, and accurate reporting while minimizing disruption to daily financial operations across KSA.

Policy & Standards Development

Our team develops IFRS-compliant accounting policies customised to each business. MFD Services ensures consistency, regulatory alignment, and practical guidance, empowering finance teams to maintain transparent and accurate reporting for local regulators and international stakeholders.

Financial Statement Conversion

Existing financial statements are adjusted to meet IFRS requirements. MFD Services verifies balances, reconciliations, and disclosures, producing transparent, regulator-ready reports that satisfy both local authorities and global stakeholders efficiently and accurately.

Training & Capacity Building

We train finance teams on IFRS application through workshops and hands-on sessions. MFD Services equips employees with the knowledge and tools to maintain accurate reporting, ensuring long-term compliance and minimizing errors in Saudi Arabia.

Ongoing Support

Continuous advisory keeps companies up to date with IFRS changes and best practices. MFD Services provides guidance on reconciliations, reporting, and compliance improvements, supporting accurate, regulator-aligned financial statements across Saudi Arabia.

What Challenges Do Companies Face in IFRS Advisory & Implementation

Businesses across KSA often encounter hurdles when adopting IFRS. MFD Services addresses these challenges through structured solutions, ensuring smooth, compliant, and accurate implementation:

Complex Transition

Shifting from local standards to IFRS is complicated. MFD Services maps existing policies, prepares reconciliations, and implements structured processes to ensure accurate adoption without disrupting daily operations, maintaining compliance and transparency.

Data Inconsistencies

Incomplete or inconsistent records can hinder IFRS implementation. MFD Services standardizes data, verifies entries, and corrects discrepancies, producing clean, regulator-ready statements for audit purposes and stakeholder reporting across Saudi Arabia.

Regulatory Compliance

Meeting ZATCA, SOCPA, and IFRS requirements is challenging. MFD Services ensures alignment with authorities, implements controls, and validates disclosures, reducing risks of penalties and audit complications for businesses operating in Saudi Arabia.

Skill Gaps

Finance teams may lack IFRS expertise. MFD Services delivers customized training and ongoing advisory to ensure accurate application of IFRS standards, enabling businesses in KSA to maintain compliant and reliable financial reporting.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Related Posts

Documents Required for IFRS Advisory & Implementation in Saudi Arabia

To maintain compliance and streamline IFRS adoption, MFD Services advises businesses in Saudi Arabia to prepare and maintain accurate financial records, including:

- Historical financial statements and ledgers

- Accounting policies and procedural manuals

- Contracts and agreements affecting financial reporting

- Payroll, HR, and operational records

- Audit trails and reconciliations

Which Laws and Authorities Govern IFRS in Saudi Arabia

IFRS implementation requires adherence to multiple authorities. MFD Services ensures your business meets the following regulatory requirements:

- ZATCA – VAT and transaction reporting

- SOCPA – Accounting standards, auditor licensing

- Ministry of Commerce (MoC) – Corporate governance filings

- National Cybersecurity Authority – Secure financial data handling

Cost & Pricing Overview for IFRS Advisory & Implementation

Pricing varies based on company size, complexity, and implementation depth. MFD Services provides guidance on cost considerations:

- Company Size: Larger firms require extensive policy design and financial statement conversion.

- Complexity: Multiple subsidiaries or international operations increase implementation effort.

- Integration: ERP or cloud accounting integration adds preparation requirements.

Technology & Tools Used in IFRS Implementation

MFD Services coordinates trusted accounting tools to deliver accurate and compliant IFRS records:

Industries We Serve with IFRS Advisory & Implementation in Saudi Arabia

MFD Services provides sector-specific IFRS advisory for businesses in KSA, including:

- Retail & E-Commerce – IFRS transition for revenue and transaction reporting

- Healthcare & Pharmaceuticals – Accurate expense tracking and compliance reporting

- Real Estate & Construction – Project accounting and cash flow control

- Finance & Banking – Audit-ready IFRS statements

- SMEs & Family-Owned Businesses – Scalable IFRS advisory and implementation

Why Choose MFD Services for IFRS Advisory & Implementation

Partnering with MFD Services ensures expert IFRS adoption in Saudi Arabia, combining regulatory knowledge, licensed professionals, and modern tools to deliver accurate, audit-ready reporting:

- Licensed IFRS experts in Saudi Arabia

- Regulator-ready, transparent documentation

- Customised solutions for industries and company size

- ERP and cloud integration for efficiency

- Continuous advisory, training, and support

Contact Us

Contact MFD Services for IFRS Advisory & Implementation in Saudi Arabia

Professional IFRS Advisory & Implementation Services in KSA ensure compliance, transparency, and operational efficiency. MFD Services coordinates licensed experts, implements IFRS frameworks, and delivers audit-ready financial reporting. Schedule your consultation today.

FAQs: IFRS Advisory & Implementation in Saudi Arabia

MFD Services provides clarity on common questions regarding IFRS adoption:

Typically 6–12 weeks depending on company size and data readiness.

Yes, scalable IFRS solutions are available for small and medium businesses.

Yes, MFD Services conducts workshops to ensure accurate application of IFRS standards.

Yes, we prepare IFRS-compliant statements aligned with ZATCA and SOCPA requirements.

Continuous advisory and updates keep your business aligned with evolving IFRS standards.