Preparation of Financial Statements Services in Saudi Arabia by MFD Services

What Are Preparation of Financial Statements Services and Why They Matter

Accurate financial reporting is the cornerstone of business transparency and compliance. Expert Preparation of Financial Statements Services in Saudi Arabia by MFD Services ensure your records are complete, regulator-ready, and aligned with ZATCA and SOCPA requirements for businesses across KSA.

Our top professionals work closely with licensed accountants to prepare balance sheets, income statements, cash flow reports, and notes, ensuring that every statement reflects the true financial position of your business.

What Types of Preparation of Financial Statements Services Do Businesses Need

To maintain robust financial reporting, MFD Services provides best-in-class services in Saudi Arabia, including:

Balance Sheet Preparation – Presenting assets, liabilities, and equity accurately for internal and external stakeholders.

Income Statement Preparation – Detailing revenue, expenses, and profit or loss in compliance with regulatory standards.

Cash Flow Statement Preparation – Tracking operational, investing, and financing cash movements for informed decision-making.

Notes and Disclosures – Providing complete explanations and breakdowns for transparency and audit-readiness.

Consolidated Financial Statements – Combining multiple entities’ statements for group-level reporting in compliance with IFRS and local regulations.

What Are the Benefits of Coordinated Preparation of Financial Statements

Engaging MFD Services ensures top Preparation of Financial Statements services in Saudi Arabia deliver significant benefits:

Regulatory Compliance: All statements align with SOCPA, ZATCA, and IFRS standards.

Accurate Decision-Making: Reliable statements allow management to make informed strategic decisions.

Operational Efficiency: Streamlined preparation processes save time and reduce errors.

Investor and Stakeholder Confidence: Transparent, professional statements build trust with banks, investors, and regulators.

Compliance Timelines for Preparation of Financial Statements Services in Saudi Arabia

Timely and accurate financial statements are essential for regulatory compliance. MFD Services helps businesses across KSA meet critical deadlines:

- Monthly Financial Statements: Prepared within 15–20 days of month-end for internal review and VAT compliance.

- Quarterly Financial Statements: Delivered within 30–45 days after the quarter-end, meeting SOCPA and ZATCA requirements.

- Annual Financial Statements: Completed 3–4 months after fiscal year-end, including all disclosures and audit support.

- Ongoing Adjustments and Reconciliations: Scheduled monthly or quarterly depending on company size to maintain accurate reporting.

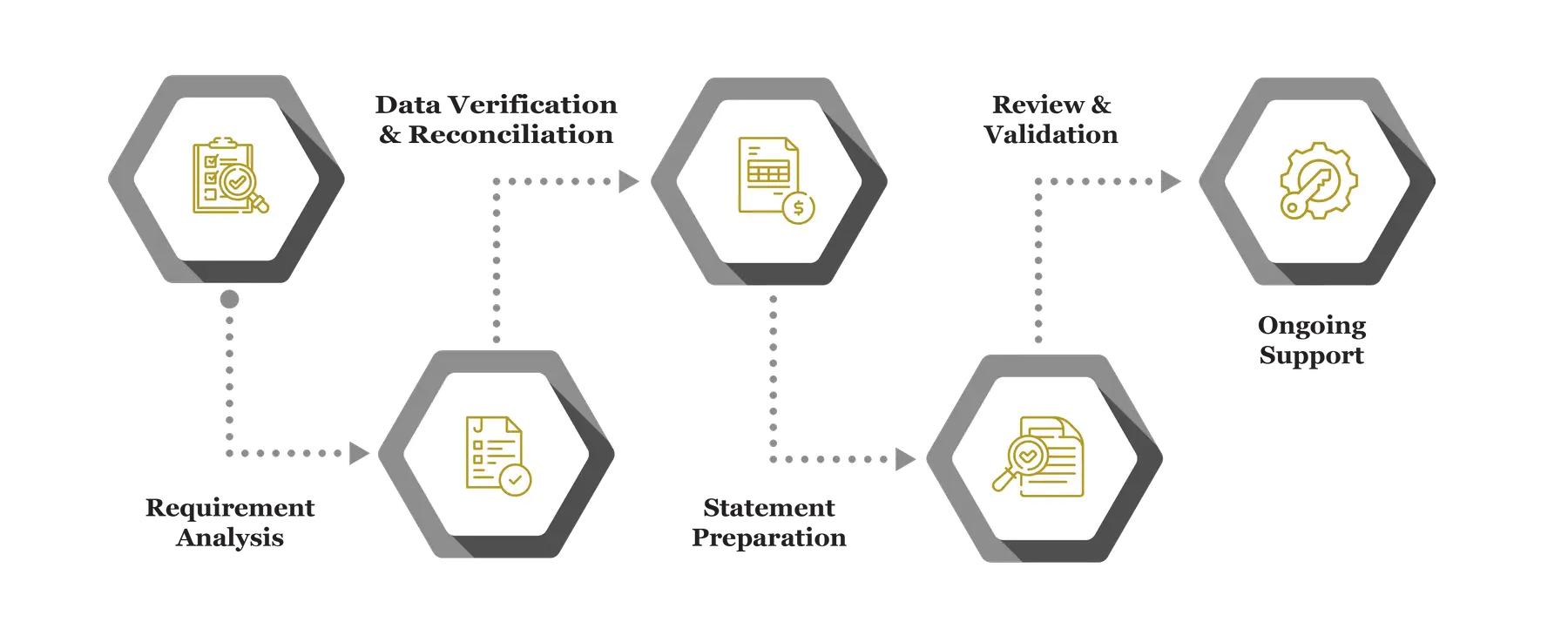

Our Process for Facilitating Preparation of Financial Statements

MFD Services follows a structured approach to deliver professional financial statement preparation in Saudi Arabia:

Requirement Analysis

We review current accounting practices, identify gaps, and design workflows for accurate statement preparation. MFD Services ensures compliance, clarity, and audit-readiness.

Data Verification and Reconciliation

All transactions and balances are verified for accuracy. MFD Services ensures ledger accounts, invoices, and payments are reconciled for reliable statements.

Statement Preparation

Our experts prepare balance sheets, income statements, cash flow reports, and notes in compliance with regulatory standards. MFD Services ensures transparency, completeness, and professional presentation.

Review and Validation

Statements are carefully reviewed against SOCPA and ZATCA standards. MFD Services validates all figures, classifications, and disclosures to minimize errors and regulatory risk.

Ongoing Support

Continuous advisory helps businesses maintain accurate and regulator-ready statements. MFD Services provides guidance on reporting updates, best practices, and compliance improvements.

What Challenges Do Companies Face in Preparation of Financial Statements

Businesses in Saudi Arabia often encounter hurdles in preparing accurate financial statements. MFD Services solves these challenges with structured and professional solutions:

Incomplete or Inaccurate Records

Missing invoices, unposted transactions, or incorrect entries can delay statements. MFD Services organizes, reconciles, and verifies records for completeness.

Technical Errors

Calculation mistakes or misclassifications can compromise accuracy. Our experts review all entries to ensure reliable and professional financial statements.

Regulatory Compliance

Statements must meet SOCPA and ZATCA requirements. MFD Services ensures full alignment to reduce penalties and audit issues.

Complex Consolidations

Combining multiple entities’ accounts can be challenging. Our licensed professionals prepare accurate consolidated statements for multi-entity organizations.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Preparation of Financial Statements in Saudi Arabia

To ensure accurate and compliant reporting, MFD Services advises businesses to maintain:

- General ledger and trial balance

- Bank statements and reconciliations

- Accounts receivable and payable records

- Payroll and HR records

- Contracts, agreements, and statutory documents

- Previous financial statements and supporting schedules

Which Laws and Authorities Govern Preparation of Financial Statements in Saudi Arabia

Financial statements must comply with local regulations. MFD Services ensures your business meets requirements of:

- ZATCA – VAT and financial reporting compliance

- SOCPA – Accounting standards and auditor licensing

- Ministry of Commerce (MoC) – Corporate governance and filings

- National Cybersecurity Authority – Secure financial data handling

Cost & Pricing Overview for Preparation of Financial Statements

Costs depend on business size, complexity, and level of detail. MFD Services provides guidance:

- Company Size: Larger firms require extensive preparation and reconciliation.

- Complexity: Multi-entity reporting or detailed disclosures increase preparation effort.

- Customization: Tailored statements for management, investors, or regulators may adjust pricing.

Technology & Tools Used in Preparation of Financial Statements

MFD Services leverages reliable tools for accurate and efficient statement preparation:

Industries We Serve with Preparation of Financial Statements in Saudi Arabia

MFD Services provides customized financial statement services for:

Retail & E-Commerce – Accurate revenue and expense reporting

Healthcare & Pharmaceuticals – Compliance-ready statements

Real Estate & Construction – Project accounting and cash flow reporting

Finance & Banking – Audit-ready and regulator-compliant statements

SMEs & Family-Owned Businesses – Scalable and professional solutions

Why Choose MFD Services for Preparation of Financial Statements

Partnering with MFD Services ensures top-quality, professional preparation of financial statements in Saudi Arabia:

- Licensed accounting and finance experts

- Transparent and regulator-ready statements

- Tailored solutions for company size and industry

- ERP and cloud integration for efficiency

- Continuous advisory and professional support

Contact Us

Contact MFD Services for Preparation of Financial Statements in Saudi Arabia

Professional Preparation of Financial Statements Services in KSA ensure compliance, transparency, and operational efficiency. MFD Services coordinates licensed experts, delivers accurate and audit-ready statements, and supports informed decision-making. Schedule your consultation today.

FAQs: Preparation of Financial Statements in Saudi Arabia

Typically 15–20 days for monthly statements, 3–4 months for annual statements depending on company size.

Yes, MFD Services provides scalable, customized solutions for small and medium-sized businesses.

Yes, MFD Services prepares accurate and compliant consolidated financial statements for multi-entity organizations.

Yes, all statements are prepared in line with ZATCA, SOCPA, and IFRS standards.

Yes, MFD Services provides continuous advisory, updates, and compliance guidance.