Agreed Upon Procedure (AUP) Services in Saudi Arabia by MFD Services

What Are Agreed Upon Procedure (AUP) Services and Why They Matter in Saudi Arabia

Agreed Upon Procedure (AUP) Services provide tailored financial reviews based on specific procedures requested by stakeholders, such as investors, regulators, or contractual parties. Professional Agreed Upon Procedure (AUP) services in Saudi Arabia ensure accurate verification, compliance, and actionable insights for businesses in KSA.

MFD Services coordinates with licensed auditors, finance experts, and compliance professionals to execute agreed procedures, analyze results, and provide objective, regulator-ready findings. Our structured approach ensures transparency, precision, and reliability for decision-making and reporting purposes.

What Types of Agreed Upon Procedure Services Do Businesses Need in Saudi Arabia

MFD Services provides expert AUP services across KSA, including:

Transaction Verification

Reviewing selected financial transactions for accuracy, completeness, and compliance with regulations.

Revenue & Expense Examination

Checking specific income or expense items to ensure validity and proper classification.

Contractual Compliance Procedures

Assessing compliance with contractual obligations or lender requirements through agreed procedures.

Internal Control Checks

Evaluating specific internal controls for efficiency, reliability, and risk mitigation.

Regulatory Reporting Support

Performing procedures requested by authorities, including VAT, SOCPA, or other regulatory reviews.

What Are the Benefits of Agreed Upon Procedure Services in Saudi Arabia

Engaging MFD Services ensures top Agreed Upon Procedure (AUP) services in Saudi Arabia deliver tangible benefits:

Objective Assurance: Procedures are performed as agreed, providing reliable findings.

Regulatory Alignment: Supports compliance with KSA accounting and corporate standards.

Risk Identification: Highlights discrepancies, weaknesses, and potential non-compliance.

Stakeholder Confidence: Transparent, evidence-based results improve trust among investors or partners.

Process Improvement: Offers insights for enhancing financial controls and operational efficiency.

Compliance Timelines for Agreed Upon Procedure Services in Saudi Arabia

Timely execution of agreed procedures is critical for compliance and decision-making. MFD Services helps businesses across KSA meet deadlines:

Planning & Scope Definition: Completed within 5–10 days to agree on procedures and objectives.

Procedure Execution: Conducted over 10–30 days depending on transaction volume and complexity.

Findings Compilation & Draft Reports: Delivered 5–15 days after execution.

Final Report Submission: Completed 5–10 days post-review with regulator or stakeholder-ready documentation.

MFD Services ensures milestone tracking, structured reporting, and clear communication throughout the process.

Our Process for Facilitating Agreed Upon Procedure Services in Saudi Arabia

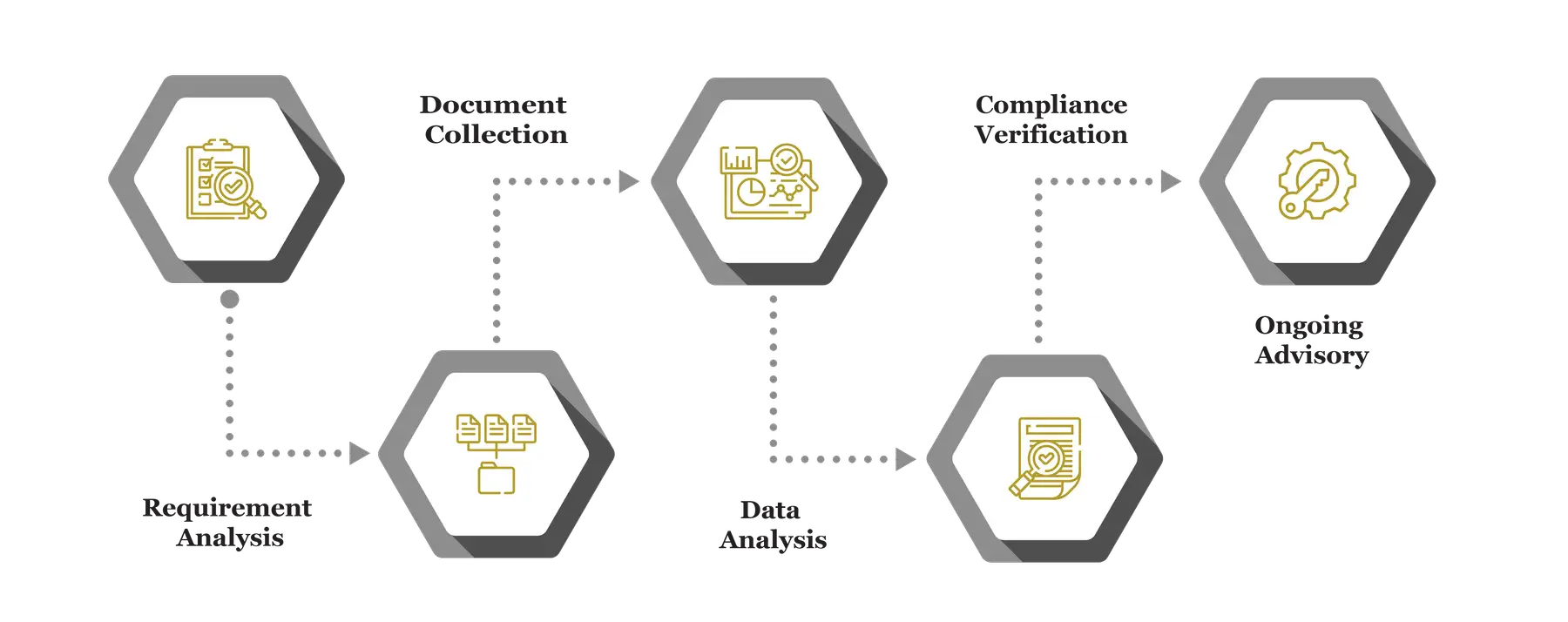

MFD Services follows a structured methodology to deliver precise and compliant AUP services:

Requirement Analysis

Understanding the agreed procedures, scope, and stakeholder expectations.

Document Collection & Verification

Gathering supporting documents, ledgers, invoices, and relevant records for accuracy.

Procedure Execution & Data Analysis

Performing the agreed tests or checks with licensed auditors and finance specialists.

Reporting & Compliance Verification

Drafting findings and validating them against Saudi regulations and stakeholder requirements.

Ongoing Advisory

Providing guidance on improving processes, internal controls, and compliance frameworks.

What Challenges Do Companies Face in Agreed Upon Procedure Services in Saudi Arabia

Businesses in KSA may encounter incomplete records, varying procedures, internal resistance, or limited regulatory knowledge. MFD Services addresses these issues with structured approaches and expert advisory.

Incomplete Records

Missing supporting documentation can delay execution. We reconstruct and validate data to ensure accuracy.

Procedure Complexity

Diverse procedures may be requested by stakeholders. MFD Services customizes execution to meet specific objectives.

Internal Resistance

Employees may resist cooperation. We coordinate with management to streamline information flow.

Limited Regulatory Awareness

Companies may be unaware of compliance expectations. MFD Services ensures adherence to KSA laws and standards.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Agreed Upon Procedure Services in Saudi Arabia

To support effective execution, businesses should maintain:

- Financial statements and ledgers

- Invoices, receipts, and supporting documentation

- Contracts and agreements

- Internal control records and operational logs

- Prior reports or regulator submissions

Which Laws and Authorities Govern Agreed Upon Procedure Services in Saudi Arabia

MFD Services ensures compliance with regulatory authorities in KSA:

- SOCPA – Accounting and reporting standards

- Ministry of Commerce (MoC) – Corporate and contractual compliance

- ZATCA – VAT and financial reporting verification

- Saudi Courts & Arbitration Bodies – Legal and contractual obligations

- National Cybersecurity Authority – Secure handling of financial and digital records

Cost & Pricing Overview for Agreed Upon Procedure Services

Pricing depends on:

- Scope of Procedures: Broader or complex requests require more resources.

- Data Volume: High transaction counts increase analysis and reporting time.

- Stakeholder Requirements: Specialized or regulatory procedures may incur additional coordination.

Technology & Tools Used in Agreed Upon Procedure Coordination

MFD Services coordinates trusted tools for efficient and compliant procedure execution:

Industries We Serve with Agreed Upon Procedure Services in Saudi Arabia

MFD Services delivers customized AUP support across industries:

- Finance & Banking – Transaction verification and compliance procedures

- Construction & Real Estate – Contractual and project-specific reviews

- Healthcare & Pharmaceuticals – Regulatory and operational procedures

- Retail & E-Commerce – Revenue and expense verification

- Family-Owned Businesses – Internal control and process assessments

Why Choose MFD Services for Agreed Upon Procedure Services in Saudi Arabia

Partnering with MFD Services ensures expert Agreed Upon Procedure services in KSA with:

- Regulator-ready, evidence-based findings

- Compliance with Saudi accounting and corporate standards

- Customized procedures based on business or stakeholder needs

- Confidential, reliable, and professional support

- Continuous advisory to enhance transparency and controls

Contact Us

Contact MFD Services for Agreed Upon Procedure Services in Saudi Arabia

Professional Agreed Upon Procedure services in KSA ensure accurate, regulator-ready, and stakeholder-aligned reporting. MFD Services coordinates licensed experts, prepares evidence-based findings, and provides advisory for improved compliance and process integrity. Schedule your consultation today.

FAQ's

Typically 2–6 weeks depending on scope and documentation availability.

Yes, services are scalable based on business size and procedure requirements.

Yes, reports are structured to meet stakeholder, regulatory, or contractual needs

MFD Services assists in reconstructing and validating missing information.

Yes, we provide recommendations for improving internal processes and controls.