Due Diligence in Saudi Arabia by MFD Services

What Is Expert Due Diligence and Why It Matters

Before mergers, acquisitions, or major investments, evaluating financial, legal, and operational risks is essential. Professional Due Diligence in Saudi Arabia ensures clarity, informed decisions, and compliance with regulatory standards.

MFD Services coordinates with licensed financial, legal, and tax professionals to assess documents, validate data, and highlight risks. Our team ensures findings are credible, traceable, and valuable for decision-makers in KSA.

What Types of Due Diligence Services in Saudi Arabia Do Businesses Need

To support strategic transactions, MFD Services delivers expert assessments in Saudi Arabia, including:

Financial Review

Examining financial statements, cash flows, and historical performance to identify strengths, weaknesses, or risks.

Legal Review

Reviewing contracts, corporate records, and regulatory compliance to uncover potential liabilities.

Operational Review

Evaluating internal processes, supply chains, and controls to assess efficiency and risk exposure.

Tax & Compliance Review

Verifying VAT, ZATCA alignment, and tax positions to prevent penalties or disputes.

Commercial & Market Review

Assessing sector dynamics, competitive positioning, and market sustainability.

What Are the Benefits of Coordinated Due Diligence in Saudi Arabia

Partnering with MFD Services ensures best assessment support in Saudi Arabia brings measurable advantages:

Regulatory Compliance: Reviews align with Saudi laws and sector regulations.

Risk Mitigation: Identifies financial, legal, and operational risks early.

Better Decision-Making: Clear insight supports investment planning.

Stakeholder Confidence: Credible findings increase investor trust.

Compliance Timelines for Due Diligence in Saudi Arabia

Timely Top Due Diligence Services in KSA is crucial for transaction success. MFD Services supports deadlines such as:

Pre-Transaction Analysis: Completed within 30–45 days depending on scope.

Risk Screening: Conducted during negotiation or preliminary phases.

Final Verification: Delivered before signing agreements or regulatory filings.

MFD Services ensures milestone tracking, documentation management, and regulator-ready findings.

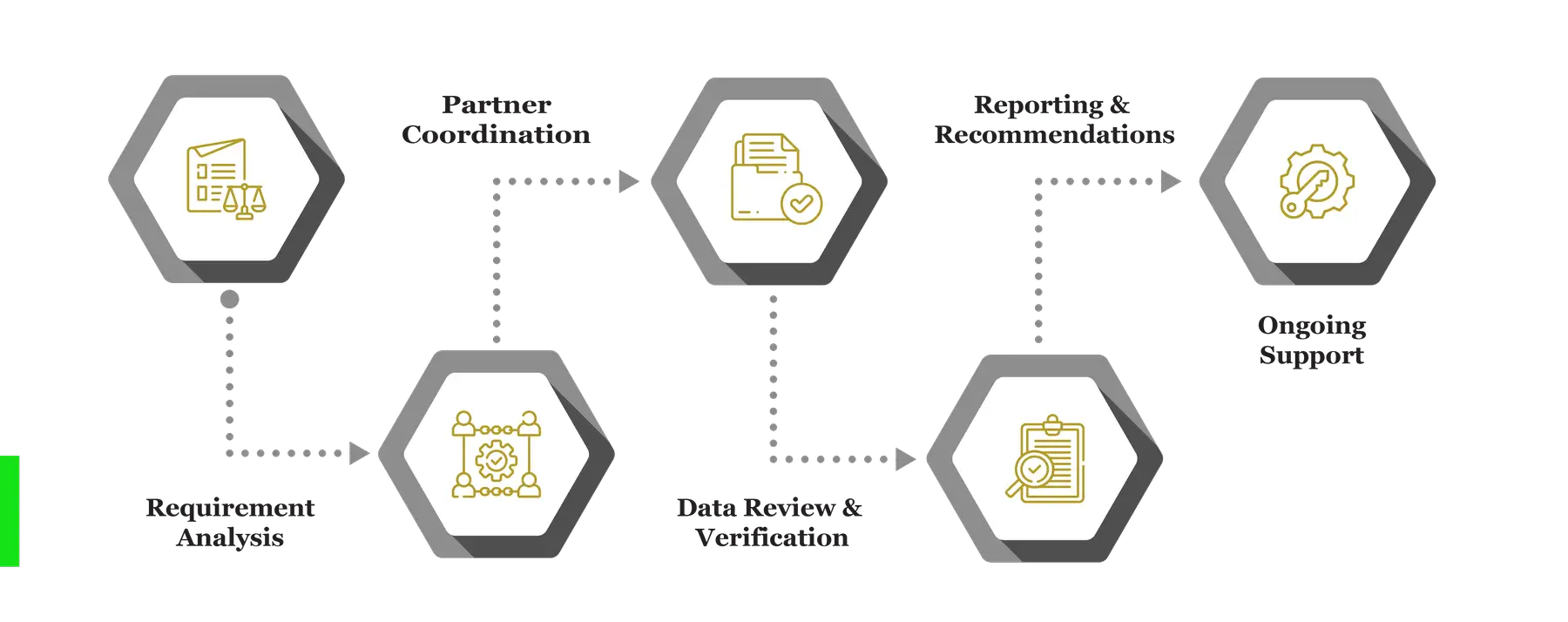

Our Process for Facilitating Top Due Diligence Services in Saudi Arabia

MFD Services follows a structured approach to deliver expert risk assessment and compliance insight:

Requirement Analysis

We examine transaction objectives, company size, and regulatory needs to create a customized evaluation plan aligned with KSA compliance.

Partner Coordination

Licensed legal, financial, and tax professionals collect and verify documents while MFD Services ensures accurate tracking and reporting.

Data Review & Verification

Statements, contracts, and compliance records are carefully analyzed to identify risks and validate credibility.

Reporting & Recommendations

Clear, structured reports summarize findings, highlight risks, and provide actionable recommendations.

Ongoing Support

Advisory continues throughout negotiations to update assessments and address regulator or investor queries.

What Challenges Do Companies Face in Due Diligence Services in Saudi Arabia

Businesses in KSA often deal with incomplete data, unclear compliance status, undisclosed liabilities, and pressured timelines. MFD Services addresses these challenges through organized documentation, expert verification, and proactive advisory.

Incomplete Documentation

Missing filings, statements, or contracts can delay assessment and create uncertainty.

Misstated Financial Data

Errors in ledgers, valuations, or tax filings may distort risk assessment.

Regulatory Uncertainty

Ignorance of ZATCA or corporate laws increases compliance risk.

Hidden Liabilities

Operational or legal issues may be overlooked without expert review.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Due Diligence in Saudi Arabia

To support accurate assessments, MFD Services advises maintaining:

Financial statements and ledgers

Contracts and corporate records

Tax and VAT filings

Bank statements and reconciliations

Internal policies and governance documents

Which Laws and Authorities Govern Due Diligence in Saudi Arabia

Best Due Diligence Services in KSA requires alignment with:

SOCPA – Financial reporting & auditing standards

ZATCA – VAT & tax compliance

Ministry of Commerce – Corporate regulations

Capital Market Authority – Listed company oversight

Cost & Pricing Overview for Expert Due Diligence Services in KSA

Pricing may vary depending on:

Company size and assessment scope

Depth of financial and legal review

Documentation volume and complexity

Technology & Tools Used in Due Diligence Services in KSA Coordination

Industries We Serve with Due Diligence Services in Saudi Arabia

MFD Services supports diverse sectors including:

Retail & E-Commerce – VAT & financial assessment

Healthcare – regulatory and operational review

Manufacturing – supply chain and cost evaluation

Real Estate – legal and contractual review

Finance – internal controls & compliance

Why Choose MFD Services for Professional Due Diligence

MFD Services ensures top professional support in Saudi Arabia backed by:

Licensed experts coordinating reviews

Transparent, regulator-ready documentation

Industry-specific risk insights

Efficient and structured processes

Ongoing advisory & transaction support

Contact Us

Contact MFD Services for Best Due Diligence in Saudi Arabia

Top Due Diligence services in KSA supports better decisions, regulatory compliance, and risk mitigation. MFD Services coordinates licensed experts and provides structured assessments. Schedule your consultation today.

FAQ's

Typically 4–6 weeks depending on documentation and transaction scope.

Yes, reviews align with SOCPA, ZATCA, and corporate laws.

Yes, scalable support is available for all business sizes.

Yes, continuous guidance is available during negotiations.