Fraud Assignment Services in Saudi Arabia by MFD Services

What Are Fraud Assignment Services and Why They Matter in Saudi Arabia

Fraud Assignment Services involve specialized investigations to detect, assess, and document fraudulent activities within an organization. Top Fraud Assignment services in Saudi Arabia help businesses safeguard assets, comply with regulations, and provide evidence for legal or regulatory purposes in KSA.

MFD Services collaborates with licensed forensic accountants, fraud examiners, and compliance professionals to conduct thorough reviews of financial records, transactions, and internal processes. Our approach ensures findings are evidence-based, traceable, and ready for regulator or legal use.

What Types of Fraud Assignment Services Do Businesses Need in Saudi Arabia

MFD Services offers expert fraud assignment support across KSA, including:

Fraud Detection & Investigation

Identifying misappropriation, irregular transactions, and unusual financial patterns.

Asset Misappropriation Review

Investigating theft, cash skimming, inventory fraud, or misuse of company resources.

Vendor & Procurement Fraud Assessment

Checking for inflated invoices, false vendors, or procurement irregularities.

Financial Statement Analysis

Detecting manipulation in revenues, expenses, or balance sheet accounts.

Litigation & Regulatory Support

Providing evidence-based reports and documentation suitable for legal proceedings.

What Are the Benefits of Fraud Assignment Services in Saudi Arabia

Engaging MFD Services ensures best Fraud Assignment services in Saudi Arabia provide measurable benefits:

Regulatory Assurance: Aligns investigation findings with Saudi commercial and financial regulations.

Fraud Prevention: Helps detect and mitigate internal and external fraud risks.

Evidence-Based Reporting: Structured documentation suitable for litigation and arbitration.

Stakeholder Confidence: Builds trust by ensuring transparency, accountability, and integrity.

Compliance Timelines for Fraud Assignment Services in Saudi Arabia

Timely execution of best fraud assignments in Saudi Arabia is critical for asset protection and regulatory compliance. MFD Services assists businesses across KSA with:

Initial Risk Assessment: Completed within 10–15 days to identify fraud indicators.

Detailed Investigation & Evidence Gathering: Conducted over 20–90 days depending on complexity.

Report Preparation & Submission: Delivered 10–30 days post-investigation with regulator-ready findings.

Legal & Regulator Coordination: Scheduled as per inquiries or legal requirements.

MFD Services ensures milestone tracking, structured reporting, and clear communication for timely outcomes.

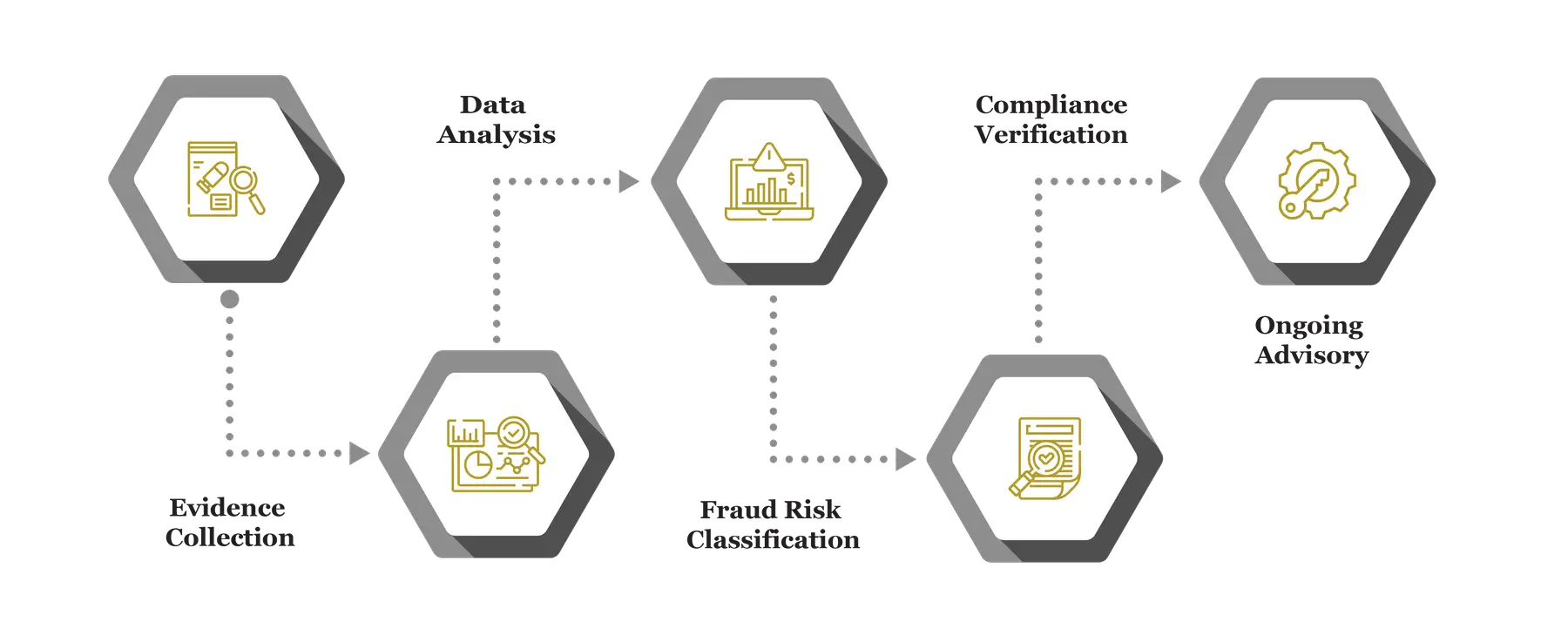

Our Process for Facilitating Fraud Assignment Services in Saudi Arabia

MFD Services follows a structured methodology to deliver accurate and compliant top fraud assignments services in KSA:

Evidence Collection

Gathering financial records, invoices, digital logs, and supporting documentation to preserve integrity.

Data Analysis & Transaction Review

Analyzing financial records for anomalies, unusual patterns, and suspicious activities.

Fraud Risk Classification

Categorizing findings based on risk level, financial impact, and regulatory exposure.

Compliance Verification

Validating findings against Saudi laws, SOCPA standards, and regulatory requirements.

Ongoing Advisory

Supporting businesses in implementing fraud prevention frameworks and strengthening internal controls.

What Challenges Do Companies Face in Fraud Assignment Services in Saudi Arabia

Businesses in KSA often encounter incomplete records, concealed misconduct, regulatory complexity, and limited fraud awareness. MFD Services mitigates these risks through structured investigation and advisory support.

Incomplete Documentation

Missing records or logs can hinder analysis. We assist in reconstruction and validation.

Internal Misconduct

Employees may bypass controls or conceal transactions. We detect red flags and vulnerabilities.

Regulatory Complexity

Understanding compliance frameworks can be challenging. MFD Services ensures alignment with Saudi standards.

Limited Fraud Awareness

Poor monitoring and controls increase exposure. We provide training and advisory to enhance oversight.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Fraud Assignment Services in Saudi Arabia

Businesses should maintain:

- Financial statements and journals

- Invoices and supporting documentation

- Bank statements and reconciliations

- Internal control and access logs

- Contracts, procurement records, and governance documents

Which Laws and Authorities Govern Fraud Assignment Services in Saudi Arabia

MFD Services ensures compliance with regulatory authorities in KSA:

- ZATCA – VAT and financial record reviews

- SOCPA – Accounting and reporting standards

- Ministry of Commerce (MoC) – Commercial regulations and filings

- Saudi Courts & Arbitration Bodies – Legal proceedings and evidence requirements

- National Cybersecurity Authority – Secure handling of digital evidence

Cost & Pricing Overview for Fraud Assignment Services

Pricing depends on:

- Scope of Investigation: Larger or complex cases require more resources.

- Data Volume: High transaction volume increases analysis time.

- Legal Coordination: Litigation support may increase preparation efforts.

Technology & Tools Used in Fraud Assignment Services

MFD Services coordinates trusted tools to deliver accurate and compliant investigations:

Industries We Serve with Fraud Assignment Services in Saudi Arabia

MFD Services provides customized best fraud assignment services in Saudi Arabia for:

- Finance & Banking – Transaction and internal fraud detection

- Retail & E-Commerce – Inventory misappropriation and procurement fraud

- Construction & Real Estate – Billing and contract irregularities

- Healthcare & Pharmaceuticals – Supply chain and billing fraud

- Family-Owned Businesses – Internal control and transparency challenges

Why Choose MFD Services for Fraud Assignment Services in Saudi Arabia

Partnering with MFD Services ensures expert Fraud Assignment services in KSA with:

- Evidence-based, regulator-ready findings

- Compliance with Saudi laws and auditing standards

- Advanced analytical tools for fraud detection

- Customized investigations for industry-specific risks

Contact Us

Contact MFD Services for Fraud Assignment Services in Saudi Arabia

Professional Fraud Assignment services in KSA ensure transparency, fraud detection, and regulator-ready documentation. MFD Services coordinates licensed experts, prepares evidence-based reports, and supports legal and compliance needs. Request your consultation today to protect your business from financial risk.

FAQ's

Typically 6–12 weeks depending on complexity and documentation availability.

Yes, structured reports are suitable for litigation, arbitration, and regulatory inquiries.

No, they also support vendor, contractual, or regulatory investigations.

Yes, services are scalable based on risk and documentation scope.

Yes, when preserved and documented according to legal and cybersecurity standards.