Internal Audit & Risk Advisory Services in Saudi Arabia by MFD Services

What Are Internal Audit & Risk Advisory Services and Why They Matter

Internal audits assess business processes, controls, and risk exposure, ensuring operational efficiency and compliance. Professional Internal Audit & Risk Advisory Services in Saudi Arabia help organizations identify gaps, prevent losses, and strengthen governance.

MFD Services coordinates with licensed auditors and risk specialists to evaluate controls, review processes, and implement advisory solutions. Our expert approach ensures businesses achieve regulatory alignment and operational resilience.

What Types of Internal Audit & Risk Advisory Services Do Businesses Need

To maintain strong governance, MFD Services provides tailored internal audit and risk advisory services in Saudi Arabia, including:

Operational Risk Assessment

Analyzing workflows, identifying potential inefficiencies, and recommending improvements to reduce operational risk and enhance process reliability.

Compliance Review & Monitoring

Ensuring company policies and procedures adhere to SOCPA, ZATCA, and industry-specific regulations, mitigating regulatory penalties and audit risks.

Fraud Risk Management

Detecting vulnerabilities, evaluating fraud exposure, and implementing preventive measures to safeguard assets and protect stakeholder interests.

Internal Controls Evaluation

Reviewing internal control frameworks to ensure financial accuracy, operational efficiency, and robust governance.

Sector-Specific Risk Advisory

Tailored advisory for industries like healthcare, banking, or construction, addressing unique regulatory, operational, and financial risks.

What Are the Benefits of Coordinated Internal Audit & Risk Advisory

Engaging MFD Services ensures expert internal audit & risk advisorysolutions in Saudi Arabia deliver measurable advantages:

- Enhanced Governance: Strengthens internal processes and accountability.

- Risk Mitigation: Identifies and addresses operational, financial, and compliance risks.

- Regulatory Alignment: Ensures adherence to SOCPA, ZATCA, and corporate governance standards.

- Operational Efficiency: Streamlines procedures and reduces process inefficiencies.

Compliance Timelines for Internal Audit & Risk Advisory Services in Saudi Arabia

Timely internal audits and risk assessments are crucial for regulatory compliance. MFD Services assists businesses across KSA with:

- Quarterly Risk Reviews: Conducted within 15–25 days each quarter to identify gaps and suggest improvements.

- Annual Internal Audit Reports: Delivered within 3–4 months after fiscal year-end for regulator-ready compliance.

- Special Risk Advisory Projects: Scheduled as needed to address emerging operational or compliance risks.

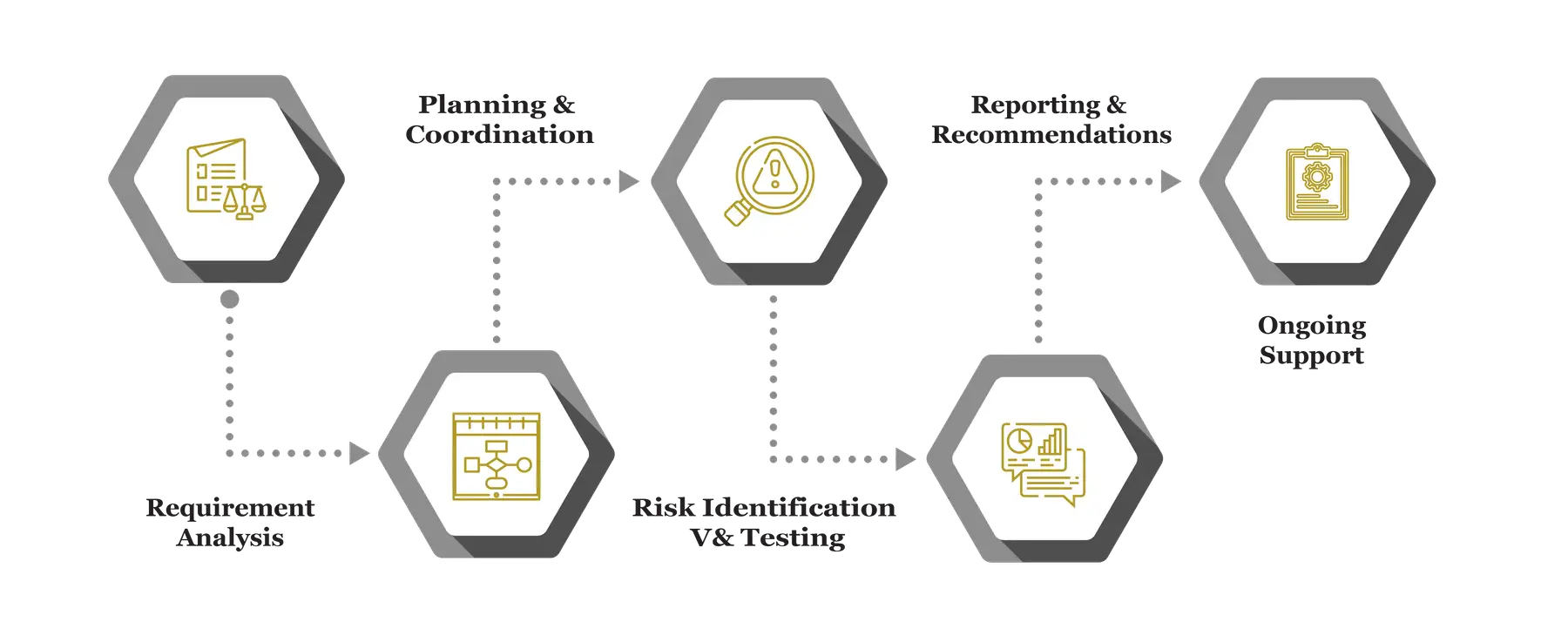

Our Process for Facilitating Internal Audit & Risk Advisory

MFD Services follows a structured approach to deliver precise internal audit and risk advisory solutions:

Requirement Analysis

We evaluate existing policies, processes, and control systems, identifying risks and gaps to design tailored internal audit workflows aligned with Saudi regulations.

Planning & Coordination

Licensed auditors and risk advisors coordinate with internal teams to access records, verify data, and streamline evaluation, ensuring accurate, compliant assessments.

Risk Identification & Testing

Detailed testing of internal controls, processes, and financial transactions detects weaknesses, fraud potential, or inefficiencies, supporting informed management decisions.

Reporting & Recommendations

Comprehensive audit and risk reports highlight findings, suggest corrective actions, and guide businesses toward improved compliance, governance, and operational performance.

Ongoing Advisory

Continuous guidance ensures companies stay aligned with evolving regulations, internal control standards, and risk management best practices.

What Challenges Do Companies Face in Internal Audit & Risk Advisory

Companies face process inefficiencies, incomplete documentation, and regulatory queries. MFD Services addresses these through structured audits and proactive advisory support.

Process Inefficiencies

Inconsistent workflows and weak controls reduce operational efficiency. We identify gaps, recommend improvements, and implement solutions to enhance process reliability and accountability.

Incomplete Documentation

Missing records or poorly maintained documentation can delay audits. We ensure complete, organized, and audit-ready documentation, reducing compliance risks and facilitating timely reviews.

Regulatory Queries

Authorities may request additional clarifications or documentation. MFD Services prepares structured responses, ensuring smooth communication with regulators while minimizing disruptions.

Limited Risk Awareness

Lack of knowledge on emerging risks or regulatory changes can impact compliance. We provide advisory, updates, and training to keep businesses aware and resilient against operational and compliance risks.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Internal Audit & Risk Advisory in Saudi Arabia

Maintaining organized records is essential. MFD Services advises clients to prepare:

Internal policies and procedures

Financial statements and ledgers

VAT and tax filings

Bank reconciliations and reports

Governance and control documentation

Which Laws and Authorities Govern Internal Audit & Risk Advisory in Saudi Arabia

Best Internal audit & risk advisory services must comply with:

SOCPA – Internal control and audit standards

ZATCA – VAT and tax compliance

Ministry of Commerce – Corporate governance and reporting

Capital Market Authority – Risk and control compliance for listed companies

Cost & Pricing Overview for Internal Audit & Risk Advisory

Pricing depends on business complexity and scope:

- Company size and audit coverage

- Depth of risk assessment and process review

- Internal control evaluation requirements

- Specialized sector-specific advisory needs

Technology & Tools Used in Internal Audit & Risk Advisory

MFD Services leverages trusted tools to enhance top internal audit & risk advisory:

Industries We Serve with Internal Audit & Risk Advisory in Saudi Arabia

MFD Services provides internal audit and risk advisory for diverse industries:

Manufacturing & Industrial – Control and risk assessment audits.

Real Estate & Construction – Process review and operational efficiency.

Retail & E-Commerce – Transaction and compliance monitoring.

Healthcare & Pharmaceuticals – Risk evaluation and regulatory compliance.

Financial & Banking – Internal controls and governance assessment.

Why Choose MFD Services for Internal Audit & Risk Advisory

Partnering with MFD Services ensures professional, structured, and reliable internal audit and risk advisory services:

Coordination with licensed auditors and risk experts

Transparent, regulator-ready documentation

Industry-specific advisory expertise in KSA

Structured processes for efficiency and compliance

Ongoing guidance and compliance support

Contact Us

Contact MFD Services for Internal Audit & Risk Advisory in Saudi Arabia

Professional Internal Audit & Risk Advisory Services in KSA enhance governance, compliance, and operational efficiency. MFD Services coordinates licensed experts, delivers audit-ready documentation, and provides actionable insights. Schedule your consultation for customised risk solutions today.

FAQ's

Typically 4–8 weeks depending on company size and complexity.

Yes, customized internal audit and risk advisory solutions are available for small and medium businesses.

Structured reports with recommendations for operational, compliance, and control improvements.

Yes, all audits and risk assessments follow SOCPA, ZATCA, and corporate governance standards.

Yes, continuous guidance ensures compliance and operational resilience.