Special Purpose Audit & Compilation Assignment Services in Saudi Arabia by MFD Services

What Are Special Purpose Audit & Compilation Assignment Services and Why They Matter in Saudi Arabia

Special Purpose Audit and Compilation Assignments are tailored financial reviews designed for specific objectives, such as compliance, internal reporting, or contractual requirements. Professional Special Purpose Audit & Compilation Assignment services in Saudi Arabia ensure accurate assessment, regulatory alignment, and actionable insights for businesses in KSA.

MFD Services collaborates with licensed auditors, finance specialists, and compliance professionals to conduct focused audits, compile financial statements, and provide expert recommendations. Our structured methodology ensures reliable, regulator-ready reports suitable for stakeholders and legal or contractual purposes.

What Types of Special Purpose Audit & Compilation Assignment Services Do Businesses Need in Saudi Arabia

To support specific financial objectives, MFD Services provides expert services in KSA, including:

Contractual Compliance Audits

Verifying that financial statements, transactions, and project accounts meet contractual or lender requirements.

Grant & Fund Audits

Examining utilization of funds, ensuring compliance with donor or grant conditions.

Compilation of Financial Statements

Preparing financial statements for internal or stakeholder use without expressing an audit opinion.

Project or Departmental Audits

Assessing accounts, expenses, and operational performance for specific projects or departments.

Regulatory & Statutory Reporting Support

Providing reports aligned with Saudi regulatory or corporate compliance requirements.

What Are the Benefits of Special Purpose Audit & Compilation Assignment in Saudi Arabia

Engaging MFD Services ensures top Special Purpose Audit & Compilation Assignment solutions in Saudi Arabia deliver tangible benefits:

Targeted Insights: Focused review highlights areas of concern or opportunity.

Regulatory Compliance: Aligns findings with KSA corporate, tax, and industry regulations.

Risk Mitigation: Identifies discrepancies, misstatements, and control weaknesses.

Stakeholder Confidence: Transparent, well-documented reports enhance credibility.

Operational Improvement: Provides actionable recommendations for process enhancements.

Compliance Timelines for Special Purpose Audit & Compilation Assignment in Saudi Arabia

Timely delivery is essential for contractual and regulatory adherence. MFD Services helps companies across KSA meet deadlines:

Initial Assessment & Planning: Completed within 7–15 days to determine scope and requirements.

Data Collection & Analysis: Conducted over 15–45 days depending on complexity.

Compilation & Draft Reports: Delivered 10–20 days after data analysis.

Final Reporting & Regulatory Submission: Completed 5–10 days post-review, including compliance confirmations.

MFD Services ensures milestone tracking, clear communication, and regulator-ready reporting.

Our Process for Facilitating Special Purpose Audit & Compilation Assignment in Saudi Arabia

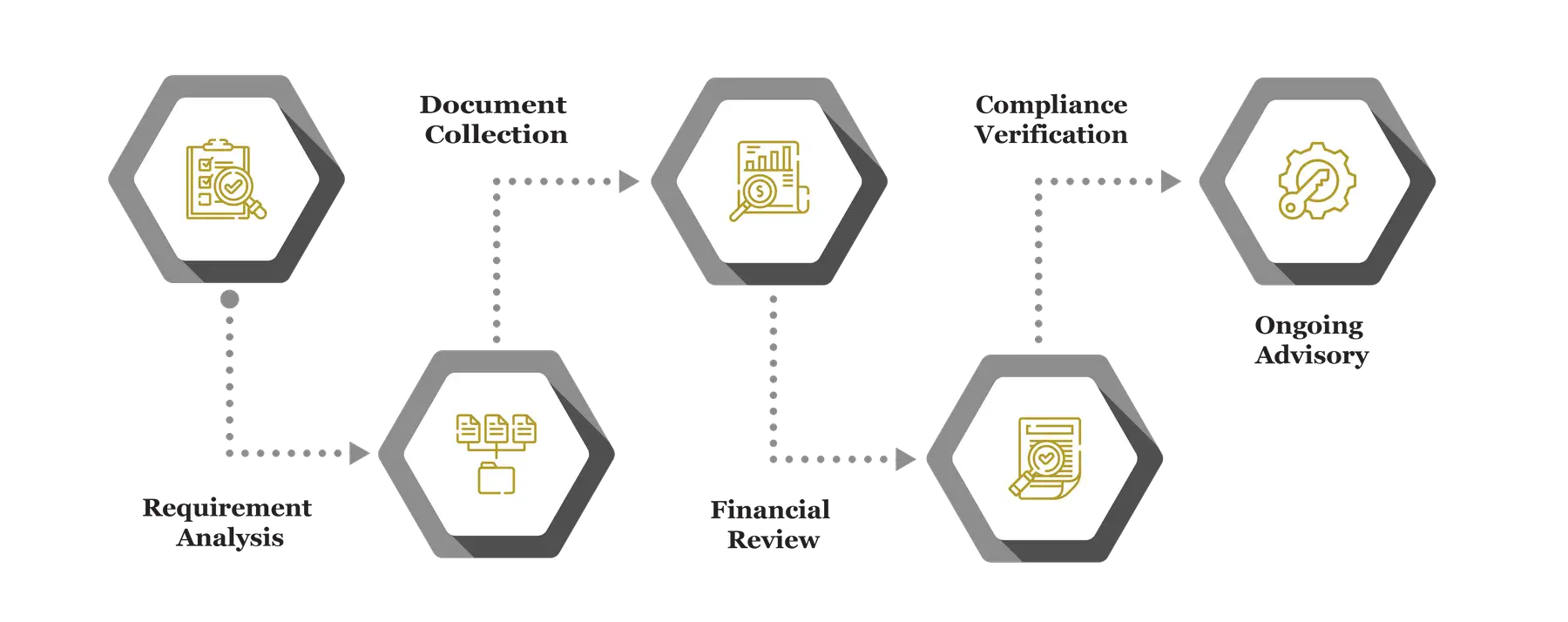

MFD Services follows a structured approach to deliver accurate and compliant audit and compilation services:

Requirement Analysis

Understanding the objective, scope, and specific reporting needs to customize the assignment.

Document Collection & Verification

Gathering ledgers, invoices, contracts, and supporting documents to ensure completeness and accuracy.

Financial Review & Analysis

Specialists assess transactions, balances, and compliance indicators using analytical procedures.

Report Preparation & Compliance Verification

Drafting regulator-ready reports and validating findings against Saudi corporate and statutory standards.

Ongoing Advisory

Providing recommendations for improved reporting, control mechanisms, and process efficiency.

What Challenges Do Companies Face in Special Purpose Audit & Compilation Assignment in Saudi Arabia

Businesses across KSA often face challenges such as incomplete records, project-specific complexities, inconsistent reporting, and limited regulatory awareness. MFD Services addresses these through structured audit and compilation procedures.

Incomplete Records

Missing invoices, contracts, or ledgers can delay review. We reconstruct and validate documentation to ensure accuracy.

Project or Departmental Complexity

Multiple projects or departments may have varying accounting methods. We streamline and reconcile data for coherent reporting.

Regulatory Awareness

Limited knowledge of local rules increases risk. MFD Services ensures alignment with Saudi corporate and statutory standards.

Inconsistent Reporting

Varying financial reporting formats create confusion. We standardize compilation for clarity and compliance.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Special Purpose Audit & Compilation Assignment in Saudi Arabia

To support effective review and compilation, businesses should maintain:

- Financial statements and ledgers

- Invoices, receipts, and supporting documents

- Contracts, agreements, and project documentation

- Internal control and departmental records

- Regulatory filings and prior reports

Which Laws and Authorities Govern Special Purpose Audit & Compilation Assignment in Saudi Arabia

MFD Services ensures compliance with authorities governing financial reporting in KSA:

- SOCPA – Accounting standards and auditor licensing

- Ministry of Commerce (MoC) – Corporate compliance and reporting

- ZATCA – VAT and financial transaction oversight

- Saudi Courts & Arbitration Bodies – Legal and contractual audit requirements

- National Cybersecurity Authority – Secure handling of financial and digital records

Cost & Pricing Overview for Special Purpose Audit & Compilation Assignment

Pricing depends on:

- Scope of Assignment: Larger or complex projects require more resources.

- Data Volume: High transaction volume increases analysis and reporting effort.

- Specialization Needs: Regulatory, grant, or contractual audits may involve higher coordination.

Technology & Tools Used in Special Purpose Audit & Compilation Assignment Coordination

MFD Services coordinates trusted tools for efficient and compliant assignment:

Industries We Serve with Special Purpose Audit & Compilation Assignment in Saudi Arabia

MFD Services provides customized audit and compilation support across industries:

- Finance & Banking – Project and compliance-focused audits

- Manufacturing & Export – Contractual and statutory review

- Construction & Real Estate – Departmental or project audits

- Healthcare & Pharmaceuticals – Regulatory compliance verification

- Retail & E-Commerce – Compilation of financial statements for stakeholders

Why Choose MFD Services for Special Purpose Audit & Compilation Assignment in Saudi Arabia

Partnering with MFD Services ensures expert Special Purpose Audit & Compilation Assignment services in KSA with:

- Regulator-ready, evidence-based reports

- Compliance with Saudi laws and accounting standards

- Tailored services for projects, departments, or contractual needs

- Confidential, professional, and reliable support

- Continuous advisory to enhance financial transparency and control

Contact Us

Contact MFD Services for Special Purpose Audit & Compilation Assignment in Saudi Arabia

Professional Special Purpose Audit & Compilation Assignment services in KSA ensure compliance, targeted insights, and regulator-ready reports. MFD Services coordinates licensed experts, prepares structured reports, and provides advisory for improved financial transparency. Schedule a consultation today for tailored audit solutions.

FAQ's

Typically 4–8 weeks depending on scope and complexity.

Yes, scalable assignments are available for small and medium-sized enterprises.

Yes, reports are structured to meet regulatory, contractual, and stakeholder requirements.

MFD Services assists in reconstructing and validating missing data.

Yes, ongoing support and guidance are provided to improve financial processes.