Joint Venture Setup in Saudi Arabia by MFD Services

What Is Joint Venture Setup and Why It Matters

Forming a joint venture requires careful legal structuring, financial planning, and strategic alignment between partners. Professional Joint Venture Setup in Saudi Arabia by MFD Services ensures businesses establish partnerships efficiently while minimizing risks and optimizing operational outcomes.

MFD Services works closely with top legal, financial, and business experts to guide companies in KSA through partner selection, agreement drafting, compliance, and operational integration. Our professional approach ensures that all joint ventures are fully compliant, transparent, and structured for long-term success.

Paste Paragraph Text

What Types of Joint Venture Setup Services Do Businesses Need

To establish a robust joint venture, MFD Services offers expert services in Saudi Arabia, including:

Legal Structuring & Agreements

Drafting shareholder agreements, MOUs, and governance frameworks that clearly define roles, responsibilities, and profit-sharing.

Regulatory Approvals & Licensing

Coordinating with MoC, ZATCA, SAGIA, and sector-specific authorities to secure all necessary approvals.

Financial & Tax Advisory

Advising on capital allocation, profit distribution, VAT compliance, and tax-efficient structures.

Operational Alignment

Aligning management roles, reporting systems, and business processes between partners to ensure smooth operations.

Risk Assessment & Mitigation

Identifying potential operational, financial, and compliance risks and implementing strategies to minimize exposure.

What Are the Benefits of Professional Joint Venture Setup

Engaging MFD Services for Joint Venture Setup in Saudi Arabia delivers tangible advantages:

- Regulatory Compliance: Ensures all JV structures meet KSA laws and regulations.

- Risk Reduction: Structured agreements and professional guidance minimize disputes and operational risks.

- Operational Efficiency: Coordinated systems and reporting enhance partner collaboration.

- Investor Confidence: Transparent governance and financial management increase credibility with stakeholders.

Compliance Timelines for Joint Venture Setup in Saudi Arabia

MFD Services ensures timely execution for all aspects of JV formation:

- Legal Structuring & Documentation: Completed in 3–5 weeks to ensure clear and compliant agreements.

- Regulatory Approvals & Licensing: Secured within 4–6 weeks depending on industry and licensing requirements.

- Financial & Tax Setup: Completed within 2–4 weeks to optimize capital structure and compliance.

- Operational Coordination: Initiated immediately after approvals for seamless business operations.

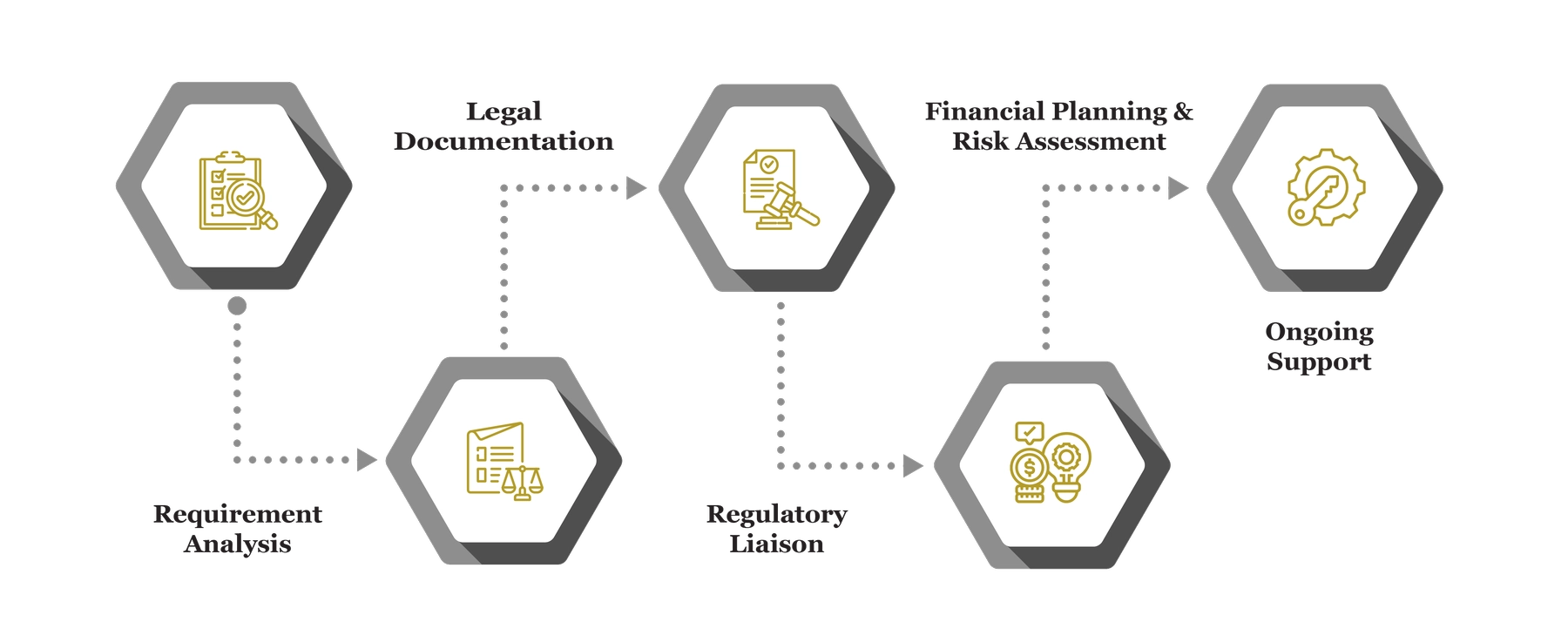

Our Process for Facilitating Joint Venture Setup

MFD Services follows a structured, step-by-step approach to deliver expert JV guidance in Saudi Arabia:

Requirement Analysis

We evaluate business objectives, strategic alignment, and partner compatibility to design a JV structure tailored for KSA regulations.

Legal Documentation & Agreement Drafting

Our experts prepare shareholder agreements, MOUs, and compliance documents that clearly define rights, responsibilities, and exit strategies.

Regulatory Liaison

MFD Services manages all approvals and registrations with MoC, ZATCA, SAGIA, and other relevant authorities, ensuring smooth and compliant formation.

Financial Planning & Risk Assessment

Comprehensive analysis identifies capital needs, profit-sharing models, and operational risks, allowing informed decision-making for all partners.

Ongoing Support

Continuous advisory ensures regulatory updates, operational alignment, and dispute resolution are managed effectively for long-term JV success.

What Challenges Do Companies Face in Joint Venture Setup

Businesses in Saudi Arabia face multiple challenges when establishing joint ventures. MFD Services addresses these challenges with structured solutions:

Regulatory Complexity

Navigating MoC, ZATCA, and sector-specific approvals can be complex. We ensure full compliance with all legal requirements.

Partner Misalignment

Differences in objectives or management style can disrupt operations. MFD Services aligns partners through governance frameworks and clear agreements.

Financial Structuring Risks

Improper capital or profit allocation can affect JV performance. Our experts design optimized financial models to mitigate risk.

Operational Integration

Integrating reporting systems, processes, and management can be challenging. MFD Services ensures seamless operational alignment between partners.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Joint Venture Setup in Saudi Arabia

To ensure smooth and compliantbest Joint Venture Setup , MFD Services recommends businesses maintain:

- Partner agreements and MOUs

- Financial statements and capital plans

- Legal and regulatory filings

- Licensing and approval documents

- Tax and VAT compliance records

Which Laws and Authorities Govern Joint Venture Setup in Saudi Arabia

Joint Venture Setup in KSA must comply with regulations from:

- Ministry of Commerce (MoC) – Corporate registration and governance

- Zakat, Tax, and Customs Authority (ZATCA) – VAT and tax compliance

- Saudi Arabian General Investment Authority (SAGIA) – Foreign investment approvals

- Sector-specific regulators – Industry licensing and operational permits

Cost & Pricing Overview for Joint Venture Setup

The cost of JV setup depends on complexity, size, and partner requirements. MFD Services provides guidance based on:

- Company Size: Larger ventures require more extensive legal and financial planning.

- Customization Depth: Tailored agreements and financial models may influence costs.

- Regulatory Requirements: Industry-specific licenses and approvals can impact fees.

Why Choose MFD Services for Joint Venture Setup

Partnering with MFD Services for Joint Venture Setup in Saudi Arabia ensures professional, compliant, and efficient formation of partnerships.

- Structured agreements and governance frameworks

- Expert financial and tax advisory

- Smooth regulatory approvals and licensing

- Operational process alignment between partners

- Ongoing advisory support for JV sustainability

Contact Us

Contact MFD Services for Joint Venture Setup in Saudi Arabia

Professional Joint Venture Setup in Saudi Arabia by MFD Services ensures legal compliance, operational alignment, and financial efficiency. Partner with our experts to establish strong, sustainable joint ventures in KSA.

FAQs: Joint Venture Setup in Saudi Arabia

Typically 4–8 weeks depending on regulatory approvals, licensing, and partner alignment.

Yes, MFD Services ensures compliance with SAGIA and sector-specific regulations.

Structured agreements and advisory support from MFD Services help resolve conflicts efficiently.

Yes, expert guidance ensures all financial, tax, and VAT obligations are met.