Expert Transaction Advisory Services in Saudi Arabia by MFD Services

What Are Transaction Advisory Services and Why They Matter

Transaction Advisory Services help businesses navigate complex deals, investments, and financial decisions. Professional Transaction Advisory in Saudi Arabia ensures organizations assess risks accurately, optimize returns, and make strategic, informed choices.

MFD Services works with experienced advisors, financial analysts, and regulatory specialists to provide clear, structured guidance. Our top team delivers actionable insights for successful transactions, ensuring compliance and value maximization.

What Types of Transaction Advisory Do Businesses Require

To strengthen business strategies, MFD Services offers specialized Transaction Advisory in Saudi Arabia, including:

Mergers & Acquisitions Guidance

Supporting companies through due diligence, valuation, and deal structuring to achieve effective mergers and acquisitions.

Financial Analysis & Due Diligence

Comprehensive evaluation of financial statements, risks, and potential liabilities to inform transaction decisions.

Business & Asset Valuation

Providing independent, top-quality valuations to ensure fair pricing for businesses or assets.

Deal Structuring and Negotiation

Designing transaction frameworks and assisting in negotiations to maximize financial and operational benefits.

Post-Transaction Support

Guiding companies through smooth operational and financial integration following deal closure.

What Are the Benefits of Engaging Professional Transaction Advisory

Partnering with MFD Services provides top Transaction Advisory solutions in Saudi Arabia with tangible advantages:

- Risk Assessment: Identifies potential operational, legal, and financial risks.

- Optimized Returns: Ensures clients derive maximum value from transactions.

- Regulatory Alignment: Keeps all activities compliant with Saudi standards.

- Strategic Planning: Offers actionable insights for future growth and decision-making.

Timelines for Transaction Advisory Services in Saudi Arabia

Timely transaction advisory ensures smooth, efficient transactions. MFD Services assists businesses in meeting key deadlines:

- Initial Assessment: 5–7 days to review scope, financials, and objectives.

- Due Diligence & Analysis: 10–15 days for risk and financial evaluations.

- Deal Structuring & Documentation: 15–20 days to finalize agreements and approvals.

- Integration Support: Continuous guidance until post-transaction alignment is achieved.

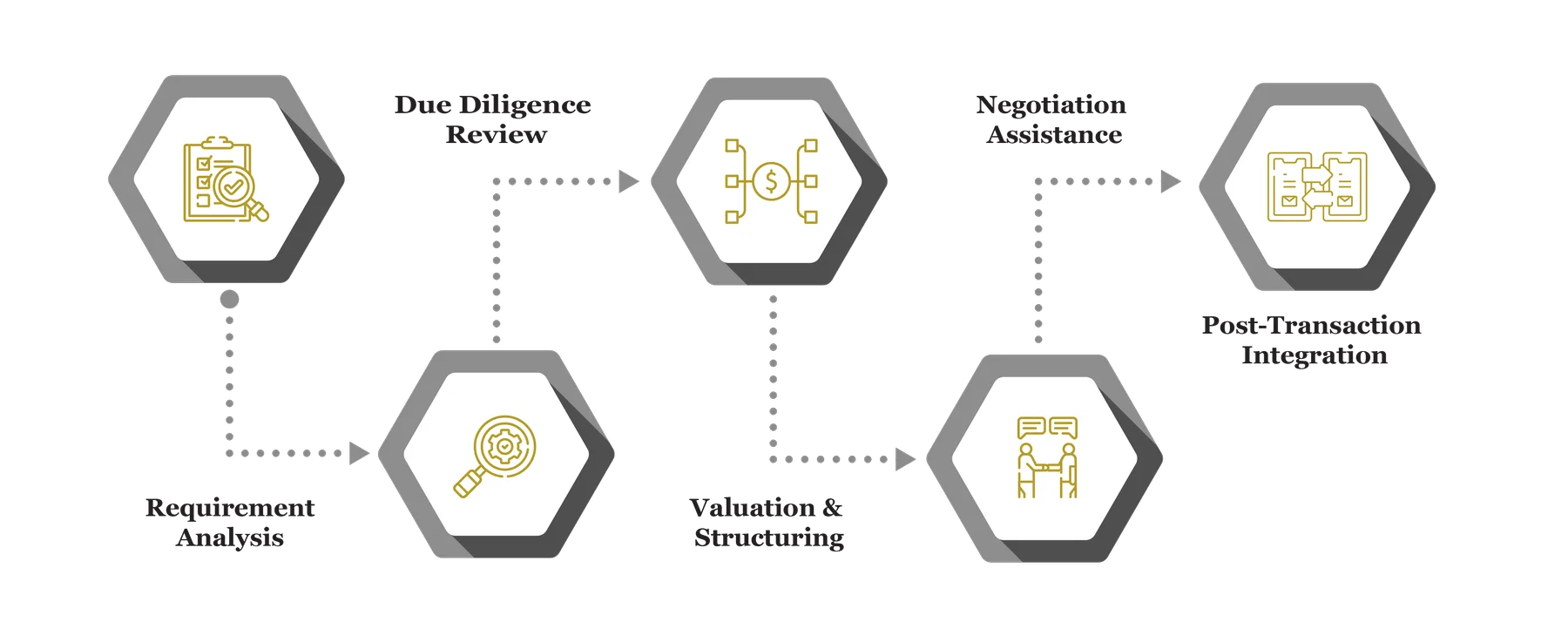

Our Process for Providing Top Transaction Advisory

MFD Services follows a clear, professional approach in delivering expert Transaction Advisory in Saudi Arabia:

Requirement Analysis

We evaluate company goals, transaction scope, and financial conditions to design a customized advisory plan.

Due Diligence Review

Expert analysts assess financial, operational, and legal aspects to reduce risk and enhance decision-making.

Valuation & Structuring

Independent valuations and tailored deal structures are created to maximize business benefits.

Negotiation Assistance

Our professional team guides negotiations, ensuring transparency, fairness, and optimal outcomes.

Post-Transaction Integration

Top advisors monitor integration and compliance, ensuring operational efficiency after deal completion.

Challenges Companies Face in Transaction Advisory

Businesses in Saudi Arabia face hurdles such as regulatory complexities, valuation disputes, financial exposure, and integration challenges. MFD Services resolves these with structured advisory and practical solutions.

Financial Exposure

Risk of financial loss due to inadequate assessment. Our experts provide thorough evaluation and actionable recommendations.

Regulatory Complexity

Compliance with Saudi regulations can be challenging. Professional guidance ensures full alignment and approvals.

Valuation Conflicts

Disagreements over asset pricing may arise. MFD Services delivers independent, objective valuations to support fair negotiations.

Integration Difficulties

Post-deal operational misalignment can reduce efficiency. Our team ensures seamless integration for business continuity.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Transaction Advisory in Saudi Arabia

For smooth advisory services, companies should prepare:

- Financial statements and audit reports

- Corporate governance and ownership documents

- Transaction contracts and agreements

- Assets and liabilities records

- Regulatory filings and compliance evidence

Which Laws and Authorities Govern Transaction Advisory in Saudi Arabia

MFD Services ensures adherence to key authorities:

- Ministry of Commerce (MoC) – Corporate approvals and transaction licensing

- Zakat, Tax and Customs Authority (ZATCA) – Tax compliance and reporting

- Capital Market Authority (CMA) – Oversight of mergers and acquisitions

- Saudi Arabian Monetary Authority (SAMA) – Financial and regulatory approvals

Cost & Pricing Overview for Transaction Advisory

Pricing varies depending on complexity and company size. MFD Services offers guidance on:

- Company Scale: Larger organizations need detailed analysis; SMEs require focused support.

- Deal Complexity: Multi-party transactions demand extensive advisory and due diligence.

- Customization Level: Tailored guidance for unique business objectives may affect costs.

Technology & Tools Used in Transaction Advisory

MFD Services leverages advanced tools to provide accurate analysis, documentation, and reporting:

Industries We Serve with Transaction Advisory in Saudi Arabia

MFD Services provides tailored advisory across multiple industries:

- Retail & E-Commerce – Deal structuring and M&A support

- Healthcare & Pharmaceuticals – Strategic transaction guidance

- Manufacturing & Industrial – Risk assessment and structuring

- Finance & Banking – Investment and regulatory advisory

- Real Estate & Construction – Transaction planning and integration support

Why Choose MFD Services for Transaction Advisory

Partnering with MFD Services provides professional Transaction Advisory in Saudi Arabia, combining expert insights, regulatory knowledge, and strategic solutions to maximize value.

- Expert evaluation of risks and opportunities

- Professional negotiation and integration support

- Compliance with Saudi regulations and reporting standards

- Tailored advisory aligned with business objectives

- Ongoing guidance from initiation to post-deal integration

Contact Us

Contact MFD Services for Transaction Advisory in Saudi Arabia

Professional Transaction Advisory in Saudi Arabia helps businesses mitigate risk, maximize returns, and ensure compliance. MFD Services provides top advisors, structured processes, and actionable guidance. Schedule a consultation for expert advisory today.

FAQ's

Usually 4–8 weeks depending on transaction complexity and documentation readiness.

Yes, MFD Services provides customized advisory for small and medium enterprises.

Experts prepare accurate submissions; final approvals rest with the regulatory authorities.

MFD Services ensures financial, operational, and regulatory alignment after closing.