Top Payroll Management Services in Saudi Arabia by MFD Services

What Is Payroll Management and Why It Matters

Professional Payroll Management Services in Saudi Arabia ensure businesses calculate salaries, manage deductions, and process benefits while staying aligned with Saudi labor laws and tax regulations. These services streamline payroll cycles, reduce risks, and deliver audit‑ready documentation.

MFD Services directly provides expert Payroll Management in KSA, integrating ERP systems, automation frameworks, and compliance strategies. Our specialists design and implement payroll workflows that guarantee accuracy, efficiency, and regulator‑ready reporting aligned with ZATCA, SOCPA, and Saudi labor authorities.

Types of Payroll Management Services

Payroll Automation

MFD Services automates salary calculations, deductions, and benefits, ensuring accuracy and compliance with Saudi labor laws.

Employee Records Integration

We connect payroll systems with HR records, ensuring transparency and audit‑ready documentation.

Benefits & Allowances Processing

MFD Services manages allowances, insurance, and incentives with clarity and compliance.

ERP Payroll Integration

We integrate payroll workflows into SAP, Odoo, and Microsoft Dynamics, ensuring seamless connectivity and regulator‑aligned operations.

Compliance Reporting

MFD Services prepares payroll registers, reconciliations, and compliance reports aligned with ZATCA and SOCPA standards.

Benefits of Direct Payroll Management in Saudi Arabia

- Regulatory Compliance in KSA

Ensures payroll systems meet ZATCA, SOCPA, and MoL requirements, reducing risks of penalties. - Operational Efficiency

Automated workflows streamline payroll cycles, reduce manual inefficiencies, and accelerate reporting. - Data Accuracy

Integrated ERP systems eliminate payroll errors, ensuring accurate salary calculations and reconciliations. - Scalability for GCC Enterprises

Payroll solutions expand with workforce growth, supporting SMEs and large enterprises. - Investor Confidence in Saudi Arabia

Transparent, regulator‑ready payroll builds trust with stakeholders and investors.

Compliance Timelines for Payroll Management in Saudi Arabia

- Payroll Cycles

Completed monthly, ensuring salary accuracy and regulator alignment. - Benefits Administration

Processed within 2–3 weeks, aligned with Saudi labor law requirements. - ERP Integration

Delivered within 4–6 weeks, ensuring seamless HR connectivity. - Compliance Reporting

Scheduled monthly or quarterly depending on company size.

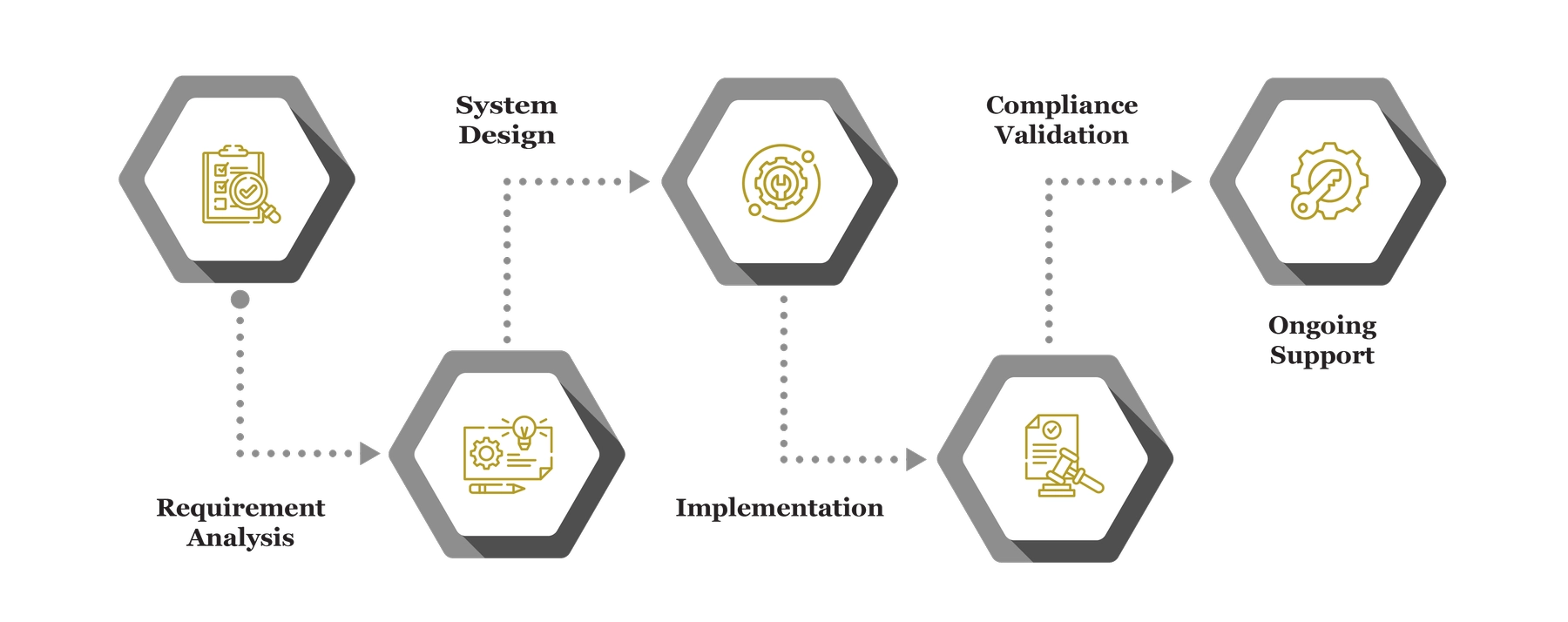

Our Process for Facilitating Payroll Management

Requirement Analysis

We review payroll practices, identify compliance gaps, and design workflows customized for Saudi businesses. This ensures accurate salary calculations, benefits administration, and regulator‑aligned reporting, maintaining transparency and audit readiness across all workforce operations consistently.

System Design

We architect secure payroll frameworks, select ERP platforms, and configure allowances, deductions, and workflows. Compliance validations, encryption, and role‑based access are embedded, ensuring regulator‑aligned payroll systems that deliver efficiency, accuracy, and transparency for Saudi enterprises.

Implementation

We integrate ERP systems, migrate employee records, automate payroll cycles, and generate regulator‑ready reports. Workflows, notifications, and calendars are orchestrated, enabling payslip generation and attendance connectivity, ensuring seamless payroll operations aligned with Saudi compliance regulations.

Compliance Validation

We verify payroll calculations, reconciliations, and filings against ZATCA, SOCPA, and Saudi labor laws. HR teams are trained, SOPs published, and stakeholders onboarded. Continuous monitoring ensures payroll cycles remain regulator‑aligned, transparent, and efficient.

Ongoing Support

We provide continuous advisory, updates, and enhancements to keep payroll systems aligned with evolving Saudi regulations. Guidance on best practices ensures businesses maintain confidence, transparency, and regulator‑ready payroll frameworks consistently.

What Challenges Do Companies Face in Payroll Management

Payroll Errors in Saudi Arabia

Manual calculations cause inaccuracies in salaries, deductions, and benefits. MFD Services automates payroll cycles, ensuring accuracy and regulator‑aligned reporting.

Compliance Risks in KSA

Outdated payroll systems fail to meet ZATCA and labor law requirements. MFD Services delivers secure, regulator‑ready payroll frameworks.

Regulator Queries in GCC

Authorities request clarifications or additional payroll documentation, slowing operations. MFD Services prepares structured responses, minimizing regulator follow‑ups.

Limited Awareness of Saudi Regulations

Rapidly evolving payroll regulations create risks. MFD Services provides training and advisory, ensuring organizations remain aligned with Saudi laws.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Payroll Management in Saudi Arabia

Accurate documentation is essential for compliance and regulator confidence. MFD Services ensures businesses prepare and maintain all required records to support payroll transparency.

Our approach guarantees audit‑ready documentation, minimizing regulator queries and ensuring operational clarity.

- Employee records and contracts

- Payroll registers and salary slips

- VAT and financial records

- Benefits and allowances documentation

- Audit trails for payroll cycles

Laws & Authorities Governing Payroll Management in Saudi Arabia

Payroll Management in Saudi Arabia is governed by strict regulatory frameworks. MFD Services ensures businesses meet all requirements by aligning payroll systems with national authorities.

Our compliance approach reduces risks, penalties, and regulator queries effectively.

- ZATCA Saudi Arabia – Oversees VAT filings and payroll reconciliations.

- SOCPA KSA – Sets accounting standards and auditor licensing requirements.

- Ministry of Human Resources & Social Development (MoL) – Ensures compliance with Saudi labor laws.

- National Cybersecurity Authority Saudi Arabia – Mandates secure handling of payroll data.

Cost & Pricing Overview for Payroll Management

Pricing depends on complexity and company needs. MFD Services provides guidance on cost considerations.

- Company Size in Saudi Arabia – Larger firms require extensive setups; SMEs have simpler requirements.

- Customization Depth in KSA – Custom workflows enhance efficiency with moderate cost adjustments.

- Integration Effort in GCC – ERP or cloud integration increases preparation requirements.

Technology & Tools Used in Payroll Management

MFD Services uses trusted platforms to deliver secure, compliant payroll solutions. Our technology stack ensures efficiency, transparency, and regulator‑aligned reporting.

We select ERP and cloud tools that align with Saudi and global compliance standards.

Industries We Serve with Payroll Management in Saudi Arabia

MFD Services provides customized Payroll Management solutions in KSA across diverse industries. Our frameworks adapt to sector‑specific compliance requirements, ensuring regulator‑aligned payroll operations.

We deliver scalable solutions for SMEs, large enterprises, and specialized industries.

- Retail & E‑Commerce Saudi Arabia

- Healthcare & Pharmaceuticals KSA

- Real Estate & Construction GCC

- Finance & Banking Saudi Arabia

- SMEs & Family Businesses KSA

Why Choose MFD Services for Payroll Management

Partnering with MFD Services ensures expert Payroll Management in Saudi Arabia that combines regulatory knowledge, licensed professionals, and modern tools to deliver accurate, audit‑ready payroll documentation.

- Compliance with Saudi regulatory requirements

- Regulator‑ready, transparent payroll documentation

- Integrated ERP and cloud solutions for efficiency

- Customized services for industries and company size

- Continuous advisory and support

Contact Us

Contact

MFD Services delivers best Payroll Management Services in Saudi Arabia, ensuring compliance, transparency, and efficiency across every payroll stage. We design, implement, and manage frameworks that align with Saudi laws and global standards. Schedule your consultation today to secure a customized Payroll Management roadmap tailored to your business needs.

FAQ's

Integration typically takes 4–6 weeks, depending on ERP selection, data quality, and required customizations.

Delays may cause penalties, regulator queries, or operational disruptions. We remediate filings and implement controls to prevent recurrence.

Yes. Automation reduces errors, standardizes processes, and lowers manual workload, making compliance faster.

Yes. Standardized calculations, audit trails, and compliance checks reduce inconsistencies, minimizing regulator follow‑ups.

Yes. Regulators provide submission confirmations; we store and reference them in audit trails for future verifications.