Refunds & Reconsiderations Advisory in Saudi Arabia by MFD Services

What Is Refunds & Reconsiderations Advisory and Why It Matters

Effective financial management requires a strategic approach to reclaiming overpaid taxes and addressing reassessment concerns. Professional Refunds & Reconsiderations Advisory in Saudi Arabia ensures businesses navigate ZATCA requirements efficiently while minimizing compliance risks.

MFD Services works with skilled tax experts to manage documentation, submissions, and follow-ups. Our experienced team ensures all refund claims and reconsideration requests are precise, traceable, and regulator-ready.

What Types of Refunds & Reconsiderations Services Do Businesses Require

To optimize cash flow and regulatory compliance, MFD Services provides expert Refunds & Reconsiderations Advisory services in Saudi Arabia, including:

VAT Refund Filing

Preparing accurate claims for overpaid VAT while adhering to ZATCA timelines.

Customs Duty Refund Support

Assisting businesses in recovering excess duties paid on imports.

Tax Reconsideration Requests

Structuring submissions for audit disputes, assessments, or tax authority clarifications.

Documentation Verification

Ensuring all supporting records are accurate, organized, and fully compliant.

Follow-up and Liaison

Coordinating with regulators to expedite approvals and minimize queries.

What Are the Benefits of Professional Refunds & Reconsiderations Advisory

Engaging MFD Services ensures top-tier advisory in Saudi Arabia delivers measurable advantages:

- Regulatory Alignment: Accurate filings meet all ZATCA requirements.

- Reduced Financial Risk: Minimizes the chance of penalties or rejected claims.

- Improved Cash Flow: Timely refunds help businesses reinvest efficiently.

- Strategic Guidance: Expert advisory reduces errors and enhances compliance.

Compliance Timelines for Refunds & Reconsiderations Advisory in Saudi Arabia

Timely submissions are critical for successful claims. MFD Services ensures businesses across KSA adhere to regulatory timelines:

- VAT Refund Submissions: Prepared and filed within 20–30 days of identifying overpayments.

- Customs Refund Applications: Completed within 30–45 days, ensuring smooth processing.

- Reconsideration Requests: Submitted promptly with full supporting documentation to ZATCA.

MFD Services also provides milestone tracking and reminder schedules to help companies avoid delays and maintain regulator-ready documentation.

Our Process for Facilitating Refunds & Reconsiderations

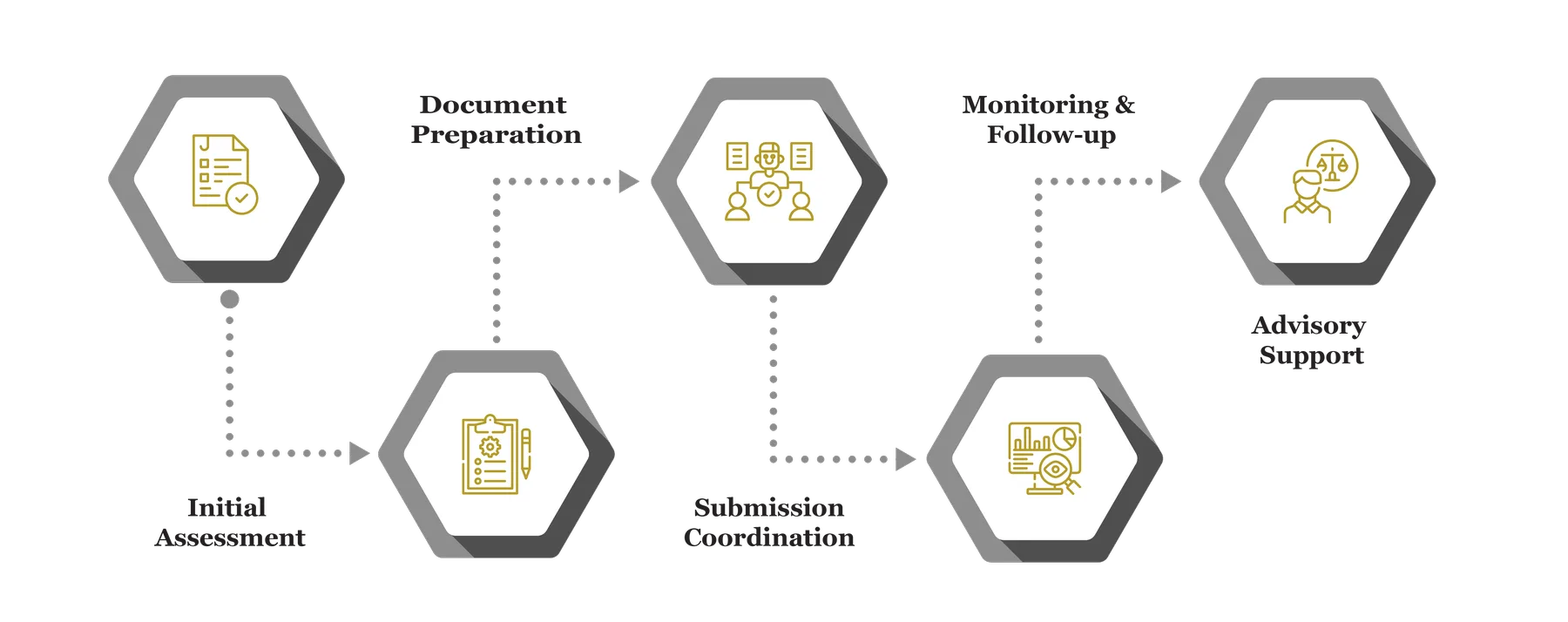

MFD Services follows a systematic approach to deliver accurate and reliable Refunds & Reconsiderations Advisory:

Initial Assessment

We review existing filings, overpayment records, and compliance status to identify potential refunds or reconsideration opportunities.

Document Preparation

Organizing invoices, ledgers, and import/export documents accurately to support claims and requests.

Submission Coordination

Ensuring filings are complete and liaising with ZATCA or other authorities for smooth processing.

Monitoring & Follow-up

Tracking claim status and promptly addressing any queries or requests from regulators.

Advisory Support

Providing continuous guidance to prevent future overpayments and optimize tax strategies.

Challenges Companies Face in Refunds & Reconsiderations

Businesses in Saudi Arabia often encounter obstacles when managing refund claims or reconsideration requests. MFD Services helps overcome these through structured processes and expert guidance.

Incomplete Documentation

Missing invoices or receipts can delay approval. We compile complete records for seamless submissions.

Regulator Queries

Authorities may request clarifications. Our team prepares accurate, clear responses to avoid delays.

Complex Tax Calculations

Errors in VAT or duty computation can reduce claim success. MFD Services ensures precise calculations aligned with ZATCA.

Missed Deadlines

Delayed filings can result in denied claims. We provide timeline management and proactive alerts to ensure compliance.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Refunds & Reconsiderations in Saudi Arabia

Businesses should maintain comprehensive and organized records for smooth processing:

- VAT invoices and reconciliations

- Customs import/export documentation

- Contracts and purchase agreements

- Previous tax assessments and payments

- Correspondence with ZATCA

Which Laws and Authorities Govern Refunds & Reconsiderations

MFD Services ensures businesses comply with relevant authorities in Saudi Arabia:

- ZATCA: VAT compliance, refunds, and tax reconsiderations

- Ministry of Finance: Regulations on customs duties and tax payments

- Saudi Customs Authority: Documentation for duty refunds

Cost & Pricing Overview for Refunds & Reconsiderations Advisory

Pricing depends on claim complexity and company requirements:

- Company Size: Larger firms with multiple filings need extensive advisory.

- Complexity of Claims: Multiple overpayments or disputes increase preparation effort.

- Integration with Accounting Systems: ERP and tax system setups may affect pricing.

Technology & Tools Used in Refunds & Reconsiderations Coordination

MFD Services leverages trusted tools to ensure accuracy and compliance:

Industries We Serve with Refunds & Reconsiderations Advisory in Saudi Arabia

MFD Services provides customized support tailored to sector-specific needs:

Retail & E-Commerce: VAT and duty refunds for high-volume transactions.

Manufacturing & Logistics: Reclaim overpaid customs duties efficiently.

Healthcare & Pharmaceuticals: Accurate tracking of imported medical supplies.

Construction & Real Estate: Refunds on large-scale project material imports.

Why Choose MFD Services for Refunds & Reconsiderations

Partnering with MFD Services ensures expert Refunds & Reconsiderations Advisory in Saudi Arabia:

- Regulatory Compliance: Accurate and ZATCA-aligned submissions.

- Proactive Guidance: Expert strategies to maximize refunds.

- Documented Process: Clear, traceable, and audit-ready records.

- Custom Solutions: Tailored for industry and company needs.

- Ongoing Support: Continuous advisory to reduce future overpayments.

Contact Us

Contact MFD Services for Refunds & Reconsiderations Advisory in Saudi Arabia

Professional Refunds & Reconsiderations Advisory in Saudi Arabia ensures efficient recovery of overpaid taxes and smooth handling of reassessment requests. MFD Services coordinates expert teams, prepares regulator-ready documentation, and guides companies through ZATCA processes. Schedule your consultation today for a tailored compliance plan.

FAQs: Refunds & Reconsiderations Advisory in Saudi Arabia

Typically 4–6 weeks depending on claim complexity.

Yes, MFD Services offers scalable advisory for businesses of all sizes.

Yes, we provide monitoring and updates throughout the process.

Absolutely, organized and accurate records ensure faster approvals.

Yes, regulators provide confirmation of submission.