Transfer Pricing Advisory in Saudi Arabia by MFD Services

What Is Transfer Pricing Advisory and Why It Matters

Transfer pricing regulations are critical for multinational companies to comply with international and local tax laws. Professional Transfer Pricing Advisory in Saudi Arabia helps businesses align intercompany transactions with ZATCA requirements while reducing audit risks.

MFD Services collaborates with skilled tax experts to analyze, document, and support intercompany pricing strategies. Our team ensures all transfer pricing policies are accurate, compliant, and audit-ready.

What Types of Transfer Pricing Services Do Businesses Need

To maintain compliance and optimize taxation, MFD Services provides expert Transfer Pricing Advisory services in Saudi Arabia, including:

Policy Development

Designing intercompany pricing structures consistent with ZATCA and OECD guidelines.

Benchmarking Analysis

Evaluating market comparables to justify pricing strategies and mitigate tax risks.

Documentation Support

Preparing comprehensive transfer pricing reports and supporting evidence for regulators.

Audit Assistance

Providing guidance during ZATCA inspections or international tax authority audits.

Risk Assessment & Strategy

Identifying potential exposure and recommending adjustments to optimize tax outcomes.

What Are the Benefits of Professional Transfer Pricing Advisory

Engaging MFD Services ensures top-tier transfer pricing solutions in Saudi Arabia deliver strategic and financial advantages:

- Regulatory Compliance: Aligns intercompany transactions with ZATCA and global standards.

- Minimized Tax Exposure: Reduces risk of penalties or adjustments.

- Operational Efficiency: Streamlined documentation saves time and effort.

- Enhanced Credibility: Transparent records build confidence with tax authorities and stakeholders.

Compliance Timelines for Transfer Pricing Advisory in Saudi Arabia

Meeting deadlines is vital to ensure regulator acceptance. MFD Services helps companies across KSA comply with timelines:

- Policy Implementation: Completed within 1–2 months of fiscal year start.

- Documentation Preparation: Submitted annually with full intercompany transaction reports.

- Audit Readiness: Continuous monitoring and updates to remain compliant throughout the year.

MFD Services provides detailed schedules and milestone tracking to maintain audit-ready records and prevent compliance gaps.

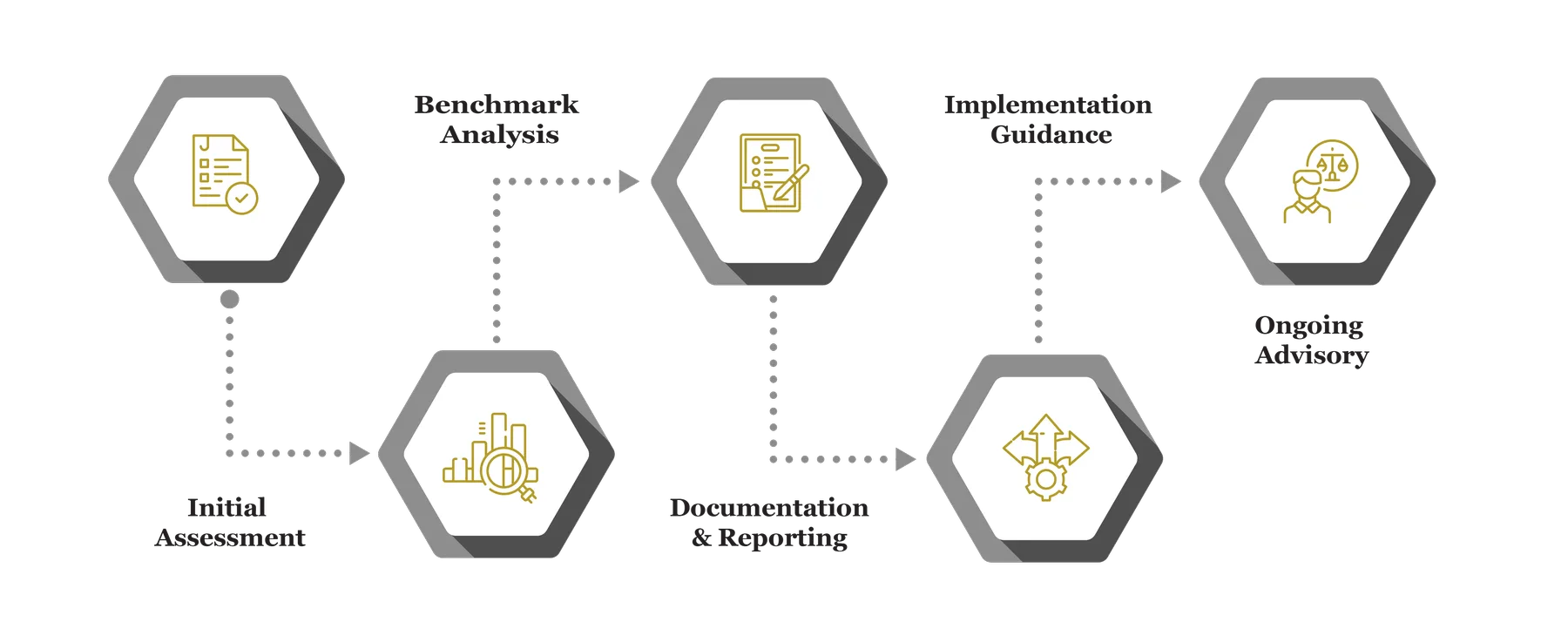

Our Process for Facilitating Transfer Pricing Advisory

MFD Services follows a structured approach to deliver expert Transfer Pricing Advisory in Saudi Arabia:

Initial Assessment

Reviewing intercompany transactions, existing policies, and compliance risks to design optimal strategies.

Benchmark Analysis

Conducting market research and comparables to justify transfer prices and mitigate exposure.

Documentation & Reporting

Preparing thorough transfer pricing reports, supporting files, and compliance evidence.

Implementation Guidance

Advising on intercompany agreements and pricing methods in line with ZATCA regulations.

Ongoing Advisory

Monitoring changes in regulations and providing updates to maintain compliant strategies.

Challenges Companies Face in Transfer Pricing

Businesses in Saudi Arabia face complex challenges in managing transfer pricing compliance. MFD Services addresses these issues with expert solutions:

Inconsistent Policies

Misaligned intercompany pricing can trigger penalties. We develop consistent, compliant policies.

Documentation Gaps

Missing or incomplete records increase audit risks. Our team ensures comprehensive, organized documentation.

Audit Exposure

ZATCA may challenge pricing methods. We prepare evidence-backed support to reduce exposure.

Regulatory Changes

Frequent updates in guidelines create uncertainty. MFD Services provides proactive updates and advisory support.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Documents Required for Transfer Pricing Advisory in Saudi Arabia

To ensure compliance, businesses should maintain detailed records. MFD Services advises clients to prepare:

- Intercompany agreements and contracts

- Invoices and transaction details

- Benchmarking reports and market studies

- Prior year transfer pricing documentation

- Correspondence with ZATCA or other regulators

Which Laws and Authorities Govern Transfer Pricing

MFD Services ensures businesses adhere to transfer pricing regulations in Saudi Arabia:

- ZATCA: Monitoring and compliance of intercompany pricing

- Ministry of Finance: Enforcement of tax regulations on related-party transactions

- OECD Guidelines: International best practices for transfer pricing documentation

Cost & Pricing Overview for Transfer Pricing Advisory

Pricing depends on company size, transaction volume, and complexity:

- Company Scale: Multinationals require extensive analysis; SMEs simpler setups.

- Transaction Complexity: Multiple intercompany transactions increase advisory effort.

- Documentation Requirements: Comprehensive reports and supporting studies affect pricing.

Technology & Tools Used in Transfer Pricing Coordination

MFD Services leverages advanced tools to maintain accuracy and compliance:

Industries We Serve with Transfer Pricing Advisory in Saudi Arabia

MFD Services provides specialized advisory for sector-specific needs:

Retail & E-Commerce: Pricing for intercompany logistics and supply chains.

Manufacturing & Industrial: Raw material and finished goods transfer pricing support.

Finance & Banking: Intercompany financial transactions and compliance checks.

Healthcare & Pharmaceuticals: Transfer pricing for imported and distributed products.

Why Choose MFD Services for Transfer Pricing Advisory

Partnering with MFD Services ensures expert Transfer Pricing Advisory in Saudi Arabia:

- Regulatory Compliance: ZATCA-aligned pricing policies and documentation.

- Expert Guidance: Strategic advisory reduces tax exposure.

- Audit-Ready Documentation: Transparent and well-organized records.

- Customized Solutions: Tailored for company size and industry requirements.

- Continuous Support: Ongoing advisory to keep companies updated on regulations.

Contact Us

Contact MFD Services for Transfer Pricing Advisory in Saudi Arabia

Professional Transfer Pricing Advisory in Saudi Arabia ensures intercompany pricing compliance, strategic optimization, and audit-ready documentation. MFD Services coordinates expert teams, prepares detailed filings, and provides ongoing advisory. Schedule your consultation today to safeguard your business.

FAQs: Transfer Pricing Advisory in Saudi Arabia

Typically 6–8 weeks, depending on company structure and transaction volume.

Yes, MFD Services offers scalable and customized solutions for small and medium businesses.

Yes, intercompany transaction reports must be updated each fiscal year.

Absolutely, professional guidance ensures ZATCA compliance and lowers penalty risks.

Yes, regulators provide acknowledgment of receipt for filed documents.