VAT Consultancy in Saudi Arabia by MFD Services

What Is VAT Consultancy and Why It Matters

Value Added Tax (VAT) is a key financial obligation for businesses in Saudi Arabia. Expert VAT Consultancy ensures correct registration, calculation, and compliance with ZATCA regulations.

MFD Services works closely with professional VAT advisors to provide comprehensive VAT solutions. Our top-tier team ensures that businesses are fully compliant, avoiding penalties, and maintaining transparent financial records for audit readiness.

What Types of VAT Consultancy Services Do Businesses Need

To maintain VAT compliance, MFD Services offers expert VAT Consultancy services in Saudi Arabia, including:

VAT Registration & Deregistration

Guiding businesses through accurate registration with ZATCA or managing deregistration processes.

VAT Compliance & Reporting

Preparing and submitting VAT returns, reconciliations, and filings aligned with local regulations.

VAT Planning & Advisory

Advising on tax-efficient strategies to reduce exposure and optimize VAT processes.

Audit Support & Dispute Resolution

Assisting during audits, providing documentation, and representing companies in compliance disputes.

Training & Process Implementation

Educating staff and establishing internal workflows to ensure ongoing VAT compliance.

What Are the Benefits of Professional VAT Consultancy

Engaging MFD Services ensures businesses in Saudi Arabia benefit from:

- Regulatory Compliance: Accurate alignment with ZATCA VAT requirements.

- Penalty Avoidance: Correct filings prevent fines and audit issues.

- Operational Efficiency: Streamlined processes reduce administrative workload.

- Business Confidence: Transparent VAT records strengthen credibility with authorities and stakeholders.

Compliance Timelines for VAT Consultancy in Saudi Arabia

Timely compliance is critical for business operations. MFD Services helps companies across KSA meet deadlines:

- Monthly VAT Filings: Completed within 15–20 days after month-end.

- Quarterly Returns: Submitted 30–45 days post quarter-end, aligned with ZATCA regulations.

- Annual VAT Reconciliation: Ensures all records are correct and complete before year-end reporting.

Our team provides milestone tracking and schedules to avoid late submissions.

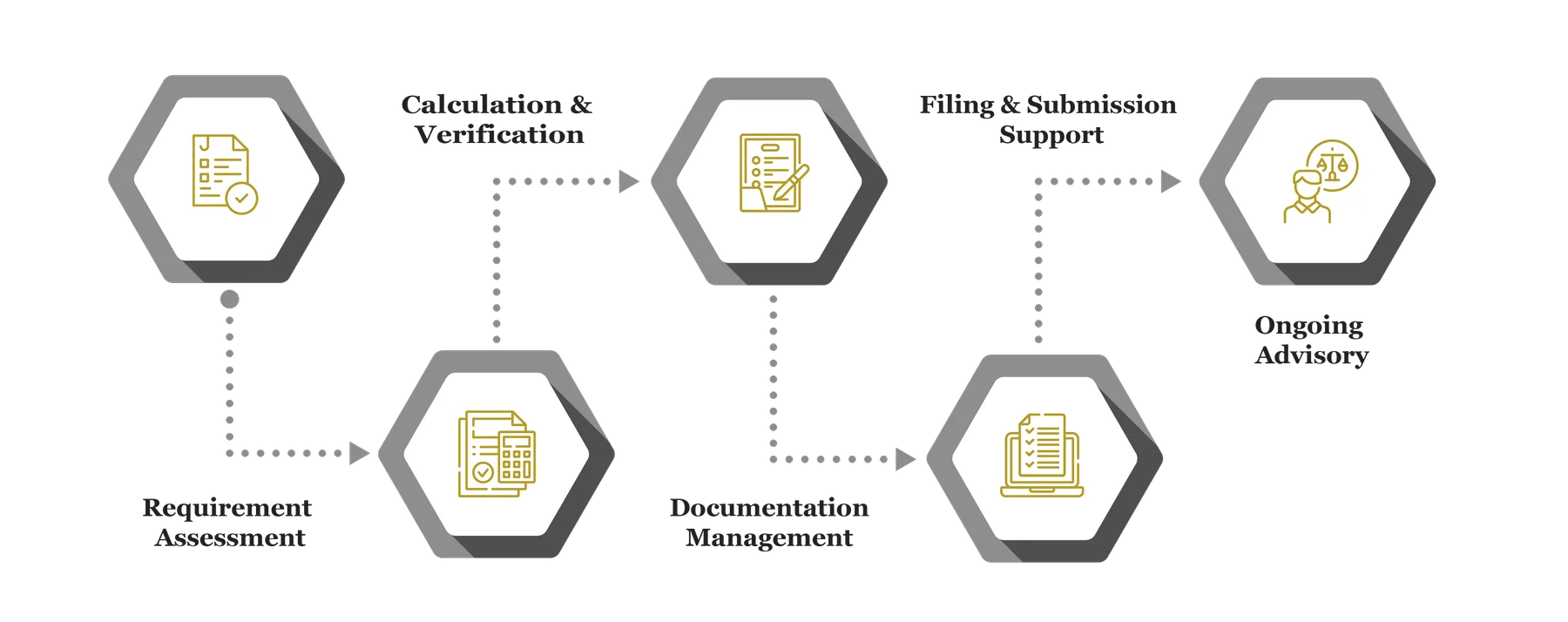

Our Process for Providing VAT Consultancy

MFD Services follows a structured approach to deliver expert VAT Consultancy in Saudi Arabia:

Requirement Assessment

Reviewing all business transactions, invoices, and ledgers to identify VAT obligations accurately.

Calculation & Verification

Ensuring precise VAT computation, classifications, and reconciliations.

Documentation Management

Organizing invoices, receipts, and records to maintain audit-ready documentation.

Filing & Submission

Handling timely submission via ZATCA portals and securing acknowledgment receipts.

Ongoing Advisory

Offering updates on VAT rules, exemptions, and compliance best practices to ensure smooth operations.

Challenges Companies Face in VAT Consultancy

Companies often face challenges in VAT compliance. MFD Services resolves these with professional solutions:

Incorrect VAT Calculations

Misclassifying transactions or miscalculating VAT can result in penalties. Our experts verify all records for accuracy.

Incomplete Documentation

Missing invoices or receipts create audit risks. We maintain organized, complete, and traceable records.

Regulatory Changes

Frequent changes in VAT rules can cause compliance issues. MFD Services provides continuous advisory updates.

Audit Exposure

Authorities may require clarifications or additional documentation. Our team prepares structured responses to minimize disputes.

Documents Required for VAT Consultancy in Saudi Arabia

To ensure compliance, businesses should maintain:

- Sales and purchase invoices

- Bank statements and payment proofs

- Contracts and agreements relevant to VAT

- Prior VAT returns and reconciliations

- Supporting documentation for exemptions or adjustments

Which Laws and Authorities Govern VAT Consultancy

MFD Services ensures adherence to Saudi VAT regulations:

- ZATCA – VAT compliance and reporting

- Ministry of Commerce – Corporate governance and documentation

- National Cybersecurity Authority – Secure handling of financial data

Cost & Pricing Overview for VAT Consultancy

Pricing depends on company size, complexity, and frequency of filings:

- Company Scale: Larger firms require more comprehensive services; SMEs simpler setups.

- Financial Complexity: Multiple entities or cross-border transactions increase advisory needs.

- Documentation Preparedness: Complete records simplify processes and reduce costs.

Technology & Tools Used in VAT Consultancy

MFD Services leverages advanced tools to deliver accurate VAT compliance:

Industries We Serve with VAT Consultancy in Saudi Arabia

MFD Services provides customized VAT solutions for different sectors:

Retail & E-Commerce: VAT on sales and transactions

Construction & Real Estate: Project-based VAT compliance

Healthcare & Pharmaceuticals: Expense tracking and VAT recovery

Finance & Banking: Cross-border VAT obligations

Why Choose MFD Services for VAT Consultancy

Partnering with MFD Services ensures expert VAT services in Saudi Arabia:

- Regulatory Compliance: Fully aligned with ZATCA rules

- Professional Guidance: Expert advice to minimize risks

- Audit-Ready Documentation: Structured and transparent records

- Tailored Solutions: Customized for each industry and business size

- Continuous Support: Updates on VAT regulations and strategic advice

Contact Us

Contact MFD Services for VAT Consultancy in Saudi Arabia

Professional VAT Consultancy ensures compliance, transparency, and accurate reporting. MFD Services coordinates expert teams, prepares audit-ready filings, and offers ongoing advisory support. Schedule your consultation today for customized VAT solutions.

FAQs: VAT Consultancy in Saudi Arabia

Typically 4–6 weeks depending on company size and financial records.

Yes, MFD Services provides tailored solutions for small and medium-sized businesses.

Absolutely, expert guidance ensures compliance and minimizes penalties.

Monthly, quarterly, and annually as per ZATCA regulations.

Yes, confirmations are provided for every successful submission.