Zakat Filing in Saudi Arabia by MFD Services

What Is Zakat Filing and Why It Matters

Zakat filing is a crucial obligation for companies operating in Saudi Arabia. Expert Zakat Filing services ensure accurate calculation, submission, and compliance with the regulations set by GAZT (General Authority of Zakat and Tax).

MFD Services works with professional tax advisors to manage Zakat obligations efficiently. Our top-tier team ensures all filings are precise, audit-ready, and compliant, helping businesses avoid penalties and maintain financial transparency.

What Types of Zakat Filing Services Do Businesses Need

To ensure smooth Zakat compliance, MFD Services provides expert Zakat Filing in Saudi Arabia, including:

Zakat Calculation

Determining the correct Zakat amount for assets, liabilities, and capital in accordance with GAZT rules.

Filing & Submission

Preparing timely monthly, quarterly, or annual filings to the relevant authorities.

Exemptions & Relief Advisory

Identifying eligible exemptions and advising on strategies to reduce financial exposure.

Audit Support

Assisting businesses during authority reviews with structured, accurate documentation.

Strategic Planning

Providing advice on financial planning to optimize Zakat payments while remaining fully compliant.

What Are the Benefits of Professional Zakat Filing

Engaging MFD Services delivers tangible benefits for companies in Saudi Arabia:

- Regulatory Compliance: Ensures alignment with GAZT requirements.

- Reduced Penalties: Accurate calculations prevent fines and audits issues.

- Operational Efficiency: Streamlined processes save time and resources.

- Financial Transparency: Clear reporting builds confidence with authorities and stakeholders.

Compliance Timelines for Zakat Filing in Saudi Arabia

Timely submission is critical to maintain compliance. MFD Services supports businesses in meeting Zakat deadlines:

- Monthly & Quarterly Filings: Completed within 15–20 days after period-end.

- Annual Filings: Delivered 2–3 months after fiscal year-end to satisfy GAZT requirements.

Our expert team monitors deadlines and maintains milestone tracking to prevent any delays.

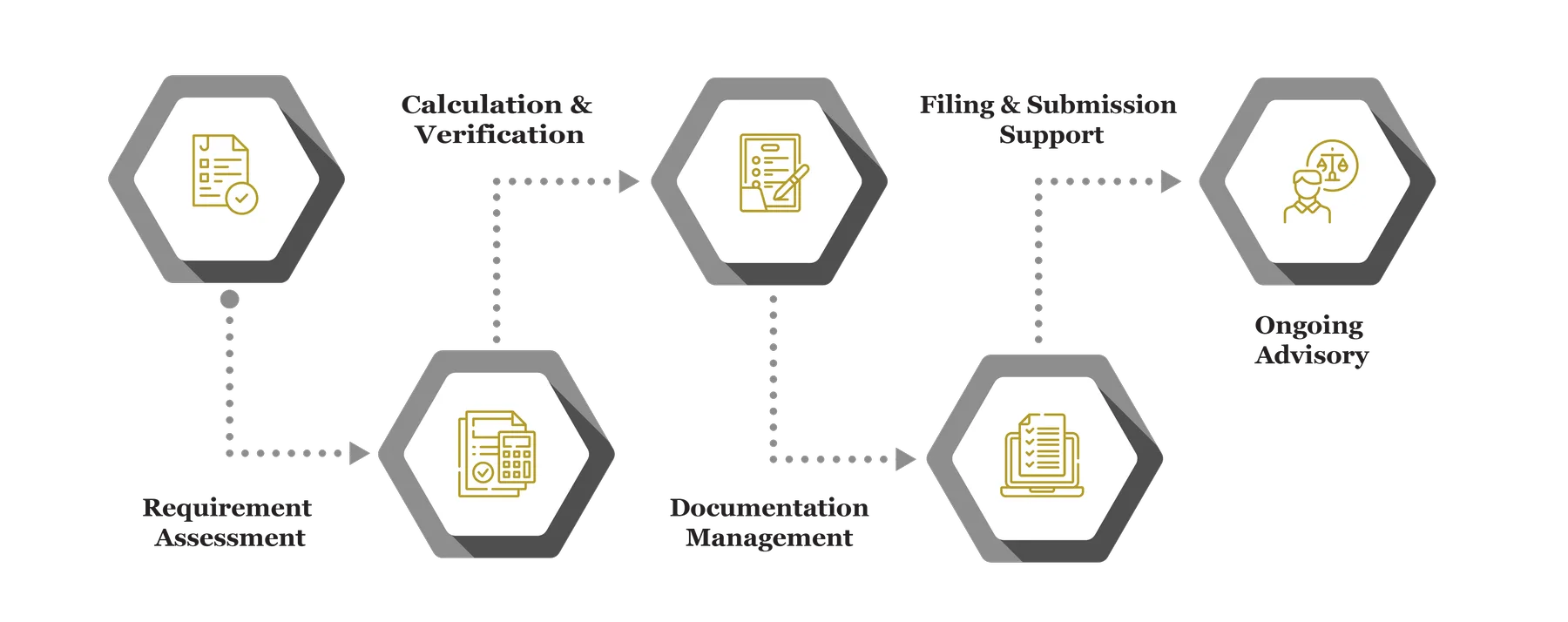

Our Process for Facilitating Zakat Filing

MFD Services follows a structured approach to provide professional Zakat Filing in Saudi Arabia:

Requirement Assessment

Reviewing financial statements, accounts, and relevant transactions to determine Zakat obligations accurately.

Calculation & Verification

Ensuring precise computation of Zakat amounts as per regulatory standards.

Documentation Management

Organizing supporting records, statements, and calculations for audit readiness.

Filing & Submission

Handling accurate online submission through GAZT portals and securing confirmation receipts.

Ongoing Advisory

Providing regular updates on regulatory changes, exemptions, and best practices to maintain compliance.

Challenges Companies Face in Zakat Filing

Companies often encounter obstacles while fulfilling Zakat obligations. MFD Services addresses these challenges with expert solutions:

Calculation Errors

Miscalculations may result in penalties or compliance risks. Our professionals verify and correct every entry.

Incomplete Records

Missing invoices or accounts can trigger audits. We maintain structured, complete, and organized financial documentation.

Regulatory Updates

Frequent changes in Zakat rules create potential non-compliance risks. We provide continuous advisory and guidance.

Audit Exposure

Authorities may request detailed clarifications. MFD Services prepares organized responses to reduce complications and ensure smooth reviews.

Book an Appointment with Us

Schedule a consultation with MFD Business Solutions today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Related Posts

Documents Required for Zakat Filing in Saudi Arabia

Businesses should prepare the following records to maintain compliance:

- Annual financial statements and ledgers

- Bank statements and payment proofs

- Contracts and agreements relevant to Zakat calculation

- Prior year Zakat filings

- Supporting documentation for exemptions or adjustments

Which Laws and Authorities Govern Zakat Filing

MFD Services ensures adherence to Saudi regulatory requirements for Zakat:

- GAZT: Zakat calculation, filing, and compliance

- Ministry of Commerce: Corporate reporting requirements

- Saudi Regulations: Industry-specific Zakat compliance obligations

Cost & Pricing Overview for Zakat Filing

Pricing depends on business size, financial complexity, and filing frequency:

- Company Scale: Larger firms require extensive review and filing; SMEs simpler setups.

- Financial Complexity: Multi-entity businesses increase advisory needs.

- Documentation Preparedness: Comprehensive records affect service costs.

Technology & Tools Used in Zakat Filing

MFD Services leverages advanced tools to ensure accurate and compliant Zakat management:

Industries We Serve with Zakat Filing in Saudi Arabia

MFD Services provides customized Zakat solutions for various industries:

Construction & Real Estate: Contractor and project obligations

Retail & E-Commerce: Vendor and operational Zakat compliance

Healthcare & Pharmaceuticals: Accurate asset and expense reporting

Finance & Banking: Intercompany and third-party payments compliance

Why Choose MFD Services for Zakat Filing

Partnering with MFD Services ensures expert Zakat Filing in Saudi Arabia:

- Regulatory Compliance: Fully aligned with GAZT requirements

- Professional Guidance: Expert advice to reduce risks

- Audit-Ready Documentation: Organized and accessible records

- Customized Solutions: Tailored advisory for each business type

- Continuous Support: Updates on rules and strategic guidance

Contact Us

Contact MFD Services for Zakat Filing in Saudi Arabia

Professional Zakat Filing in Saudi Arabia ensures compliance, transparency, and accurate reporting. MFD Services coordinates expert teams, prepares audit-ready filings, and provides ongoing advisory support. Schedule your consultation today for customized Zakat solutions.

FAQ's

Typically 4–6 weeks depending on business complexity and document readiness.

Yes, MFD Services provides tailored solutions for small and medium-sized businesses.

Yes, acknowledgments are provided after successful submission.

Absolutely, professional guidance ensures compliance and minimizes penalties.